Luxury Hospitality: Sky's The Limit

With a slew of new luxury hotel openings in the pipeline in India, and further investment eagerly pouring in, the top end of the sector is seeing a spurt in growth.

By Suman Tarafdar

Even as the hospitality sector in India is seeing unprecedented growth and energy, the top end of this space seems to be outpacing the overall increase. The trend is driven by increasing disposable incomes, rising foreign tourist arrivals, and a rising preference for experiential travel. India has had a strong presence in the luxury sector, but these have been largely limited to India’s leading cities—notably Mumbai, Delhi, Chennai, Bengaluru, Kolkata, Hyderabad and Jaipur, with exceptional outposts in other cities.

What is noteworthy today are the changes in growth patterns for the luxury sector. The top cities are adding luxury hotels—both Delhi and Mumbai are now regarded to have more than 50 ‘five-star’ hotels. However, more and more smaller cities—many of them not hitherto regarded to be capable of sustaining a luxury hotel— are being added to the list of cities supporting luxury hotels.

This growth is evident in the increasing number of luxury hotel signings and expansions, particularly in Tier II and Tier III cities, as well as established metropolitan areas. From Agra to Coimbatore, Surat to Bhubaneswar, there is significant play in the luxury hospitality space, both in new openings and further investments.

Indian hospitality is expected to host another 1,00,000 rooms in the next five-odd years, to surpass the 3,00,000-room mark by the end of the decade. A significant proportion of this is expected to belong to the premium categories—which the sector refers to as upscale, upper upscale and luxury segments.

The Indian luxury hotel market size is estimated at $2.99 billion in 2025, and is expected to reach $4.83 billion by 2030, at a CAGR of 10.06% during the forecast period 2025-2030, according to a report by Mordor Intelligence.

Significantly, an increased majority of the new supply is aimed at the domestic market, a marked departure from the earlier phase when the top tier largely catered to the inbound segment. There is a rising purchasing power parity of domestic travellers, affecting the choices of location and type of hotels, especially in the leisure segment. Rising disposable incomes are being spent on travel within the country.

While the overall leisure segment, including both the domestic and inbound markets, is growing at about 11%, the rate of domestic leisure travel is higher. The country had the second-fastest growing high-net-worth population in the world globally in 2022 (10.5%) and is poised to see a surge of nearly 60% over the next five years, according to JLL data.

"Travellers are absolutely thrilled to explore nearby resorts and indulge in luxurious destinations right within their own country," says Jaideep Dang, Managing Director, Hotels & Hospitality Group, JLL India. “They don't hold back when it comes to pampering themselves, going all out to secure top-tier accommodations and create unforgettable memories that will last a lifetime.”

India had long been an underserved market for resorts, which is now, however, growing at a fast rate across its various segments—beach side, mountains, wildlife, wellness, heritage and others. As people spend more on increased leisure as well as deeper luxury, hotels are eager to cash in.

Another huge factor that is leading to a faster-than-average growth for luxury is the increased spends on weddings by Indians. Luxury hotels are doubling as venues for lavish weddings across the country; hotels are being especially built to cater to this market with greater number of banquet facilities.

Of course, as the Indian economy grows, and India is ever more firmly integrated into the global corporate economy, business travel requirements are seeing a spurt in growth. New business hubs have top-flight business hotels as an integral part of their offerings. Airport hotels, too, often cater to top-flight business executives, and most major Indian cities are seeing a growth in airport hotels, such as the emerging second phase of Aerocity, Delhi. Long stay hotels, most often catering to corporate executives, are also on the rise.

Another segment where top-end hotels are being seen are in mixed-use development projects, where, from branded residences to luxury hotels, there is an increased focus on high-end facilities.

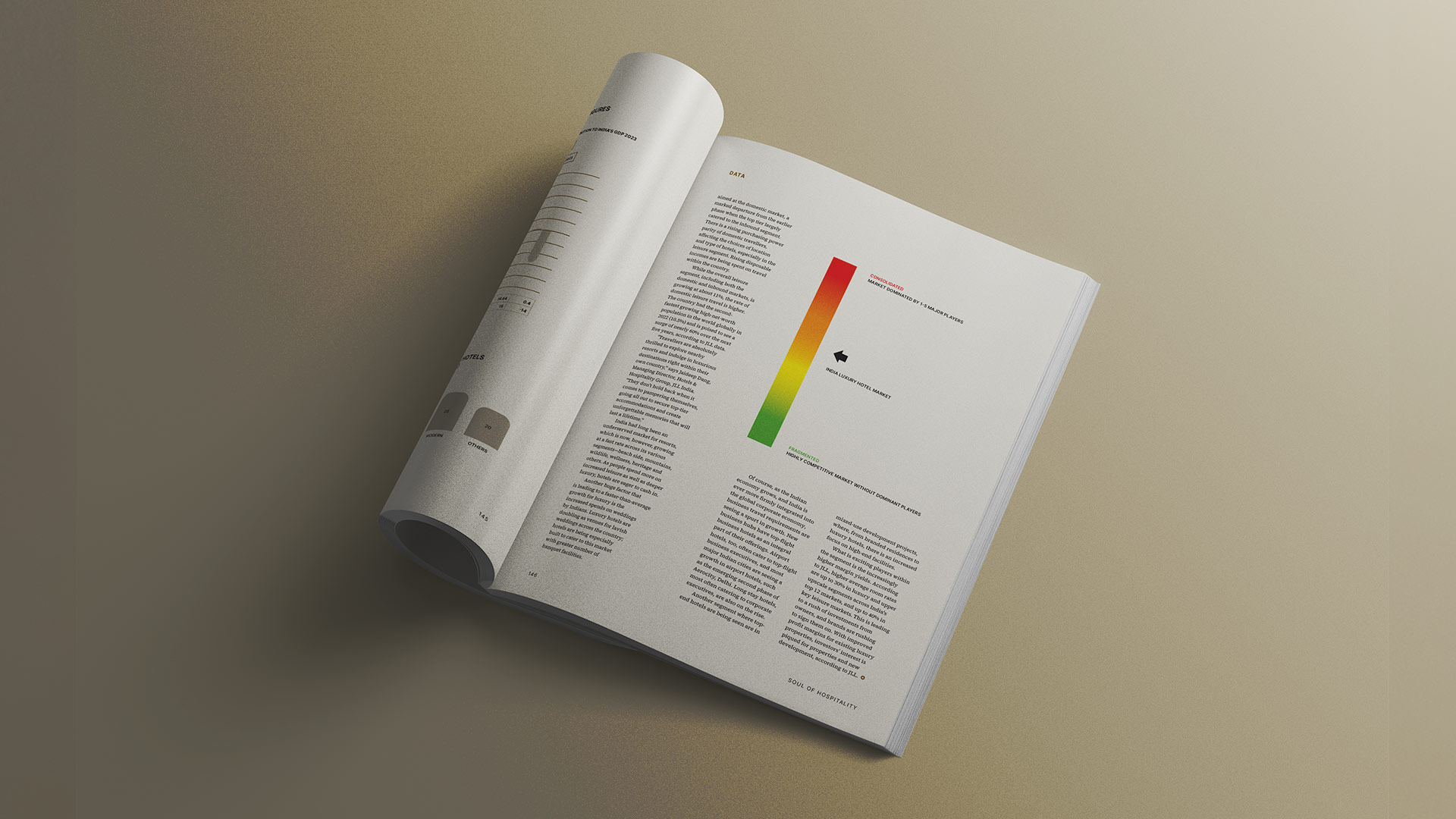

What is exciting players within the segment is the increasingly higher margin yields. According to JLL, higher average room rates are up to 30% in luxury and upper upscale segments across India's top 12 markets, and up to 40% in key leisure markets. This is leading to a rush of investments from owners, and brands are rushing to sign them on. With improved profit margins for existing luxury properties, investors’ interest is piqued for properties and new development, according to JLL.