GST Cut to Fuel India’s Hospitality Growth

India’s recent GST cut on hotel rooms up to ₹7,500 per night is set to reshape the hospitality landscape, with industry experts weighing in on how the reform will boost domestic travel, and the sector’s growth trajectory.

By SOH Team

In a significant boost to India’s hospitality industry, particularly the mid-market segment, the Indian Finance Minister, Nirmala Sitharaman, has slashed GST rates on hotel rooms priced up to ₹7,500 per night. While rooms up to ₹1,000 per night are exempt from GST, rooms up to ₹7,500 per night are brought down from 12% with Input Tax Credit (ITC) to 5% without ITC.

The GST reduction is poised to have significant effects on the hospitality sector, particularly for budget and mid-market hotels. The tax cut is anticipated to stimulate domestic travel, encouraging more weekend leisure breaks and business mobility. This aligns with India’s goal of increasing tourist arrivals, with projections of 30.5 million international tourists by 2028 and a hospitality market size reaching USD 475.37 billion by 2029.

Hoteliers expect a 5–7% increase in occupancy in leisure markets and 3–5% in business hubs, which would translate to a 7–10% revenue increase for budget and mid-scale hotels. For example, Brigade Hotels reports that two-thirds of its rooms fall below ₹7,500, contributing significantly to revenue.

Here is what industry leaders have to say.

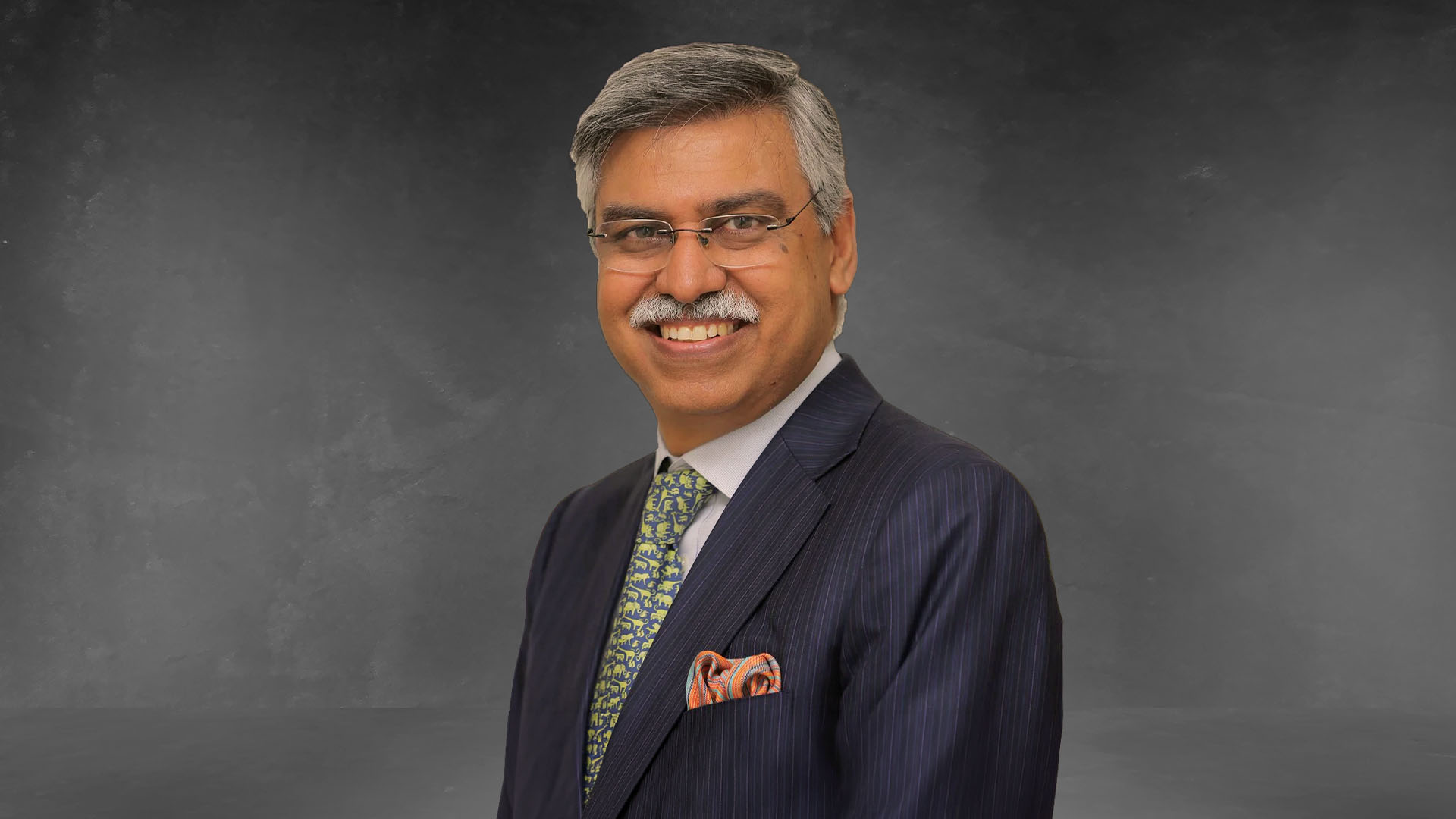

Zubin Saxena, Senior Vice President and Regional Head, South Asia, Hilton

It’s a progressive move to consider the reduction of GST on budget hotel rooms, and this initiative will provide a great boost to domestic tourism, especially the flourishing mid-market segment. I see this supporting the growth of India's hospitality sector by making it more attractive for travellers, especially those looking for budget-friendly options. With the Indian middle-class diaspora rapidly on the rise, hospitality brands are deepening their footprint in the mid-market sector, and with the rationalisation of the tax structure, the hotel stays will become far more affordable for a wider range of travellers. Hilton recently announced two strategic SLA’s for our premium economy brands, Spark By Hilton and Hampton by Hilton, and this decision will only further strengthen our plans to offer quality and affordable accommodations to travellers across India.

Zubin Saxena, Senior Vice President and Regional Head, South Asia, Hilton.

Ajay K. Bakaya, Chairman, Sarovar Hotels & Director, Louvre Hotels India

The reduction of GST on hotel accommodation priced at ₹7,500 and below from 12% to 5% is a very welcome move, particularly for the budget and mid-scale segments, which form the backbone of domestic tourism. It will directly benefit travellers through improved affordability and provide timely relief to hotels ahead of the festive season.

The removal of Input Tax Credit may act as a disincentive for much-needed investment and expansion in this category. The ₹7,500 threshold, set several years ago, also needs to be revisited—a more realistic figure today would be closer to ₹10,000 to ₹12,000, in line with inflation and rising consumer demand. Additionally, clarity on the GST treatment of food and beverages remains essential to ensure consistency.

This reform represents a step in the right direction, simplifying structures and boosting consumer sentiment. We hope future measures will build on this momentum to enable holistic growth of the sector, ensuring that hospitality continues to contribute strongly to India’s GDP, employment generation, and global competitiveness as a tourism destination.

Ajay K. Bakaya, Chairman, Sarovar Hotels & Director, Louvre Hotels India.

Tejus Jose, Director of Operations at ibis & ibis Styles India

The direct contribution of the Indian hotel industry to the country’s GDP is estimated to touch $1 trillion by 2047, driven by a significant jump in domestic tourist visits and international arrivals. As we approach the Union Budget 2025-26, the hospitality sector is optimistic about receiving continued support to fuel its growth trajectory. From an operational standpoint, we anticipate policies that ease taxation and incentivise sustainable practices, enabling hotels to adopt energy-efficient technologies without financial constraints. The reduction of GST to 5% from 12% was one of our demands. This approach enables us to offset current expenses, increase capital expenditure, open more restaurants, and ultimately generate more employment and revenue for the government.

Tier-2 and Tier-3 cities have emerged as budding heroes of the hospitality industry, with immense potential to drive the next phase of growth. We hope the government introduces incentives for investment in these regions, focusing on improved infrastructure, tax benefits for new projects, and enhanced tourism promotion initiatives. Overall, we look forward to measures that bolster tourism infrastructure, such as improved connectivity and investment in underexplored destinations, which will benefit the entire industry. A strategic focus on public-private partnerships, along with tailored support for smaller cities, can pave the way for sustained innovation and growth in the sector.

Tejus Jose, Director of Operations at ibis & ibis Styles India.

Rajesh Magow, Co-Founder and Group CEO, MakeMyTrip

The rationalisation of GST slabs is a welcome move that will act as a stimulus to the Indian economy by boosting discretionary income and fuelling consumption across sectors. For travel and tourism, the cut in GST on hotel rooms priced below ₹7,500 will make stays more affordable for a large share of Indian travellers, reinforcing demand in the domestic market.

Rajesh Magow, Co-Founder and Group CEO, MakeMyTrip.

Dr Sanjay Sethi, MD & CEO, Chalet Hotels Limited

The recent GST announcements are progressive and in line with the larger vision of nation-building and sabka vikas. They will undoubtedly provide a positive impetus to the Indian economy. A big positive for Chalet and the hotel industry in general. Placing room tariffs below ₹7,500 in the 5% GST slab is a welcome step. At the same time, it is important to address a key concern for the smaller and budget hotels. Simultaneous withdrawal of Input Tax Credit (ITC) creates an unintended anomaly.

To ensure the intent of the reform is fully realised, I would urge three corrective measures:

*Retain the benefit of ITC for this segment.

*Revise the tariff threshold upward to ₹12,000, with ITC, in line with current market dynamics.

*Link future tariff thresholds to the Consumer Price Index (CPI), so that periodic resets are not required.

These changes will make the framework more equitable, growth-friendly, and aligned with the government’s vision for tourism as a driver of inclusive development.

Dr Sanjay Sethi, MD & CEO, Chalet Hotels Limited.

Sarbendra Sarkar, Founder & MD, Cygnett Hotels and Resorts

The GST overhaul marks a turning point for India’s hospitality sector. By reducing GST on hotel stays under ₹7,500 to 5%, the government has effectively democratised travel. This will boost domestic tourism, encourage corporate travel to Tier-2 and Tier-3 cities, and improve occupancy for mid-scale hotels, which form the backbone of our industry. However, luxury hotels remain at 18%, which keeps India aligned with global practices, where premium stays are taxed at a higher rate. The challenge will be balancing this benefit with the loss of ITC, which could compress margins for some operators. Overall, the move signals a clear policy direction, making travel more affordable and inclusive, while still protecting the exclusivity of luxury experiences.

Sarbendra Sarkar, Founder & MD, Cygnett Hotels and Resorts.

Sumit Mitruka, CEO and founder, Summit Hotels & Resorts

The reforms announced at the 56th GST Council are far more than a matter of taxation; they represent a structural reset in the way India approaches housing, travel, and consumption. By placing mid-scale hotel accommodation within the 5% bracket, the government has significantly broadened affordability in domestic tourism, ensuring that demand in emerging destinations can flourish. At the same time, the simplification of GST for residential real estate through reduced construction costs and clearer slab structures is poised to stimulate housing supply and bolster confidence, particularly across Tier-II and Tier-III cities.

Hospitality and real estate are inextricably linked: affordable housing underpins urban growth, whilst accessible travel fuels mobility and commerce. A streamlined GST regime allows these sectors to reinforce one another, creating a powerful multiplier effect on employment, consumption, and investment. The task before industry leaders now is to harness these efficiencies and translate them into greater value not only for guests and homeowners, but for the wider economy.

Sumit Mitruka, CEO and founder, Summit Hotels & Resorts.

Amit Damani, Co-Founder, StayVista

The government has extended an early Diwali gift to Indian consumers. For the travel and hospitality sector, this reform will boost demand as hotels and homestays will pass on the benefit to travellers. Although what remains unclear is whether accounting will get more complex to administer, with respect to availing input tax credit, for travel and hospitality companies.

Amit Damani, Co-Founder, StayVista.