The Entrepreneur Who Broke The Mould

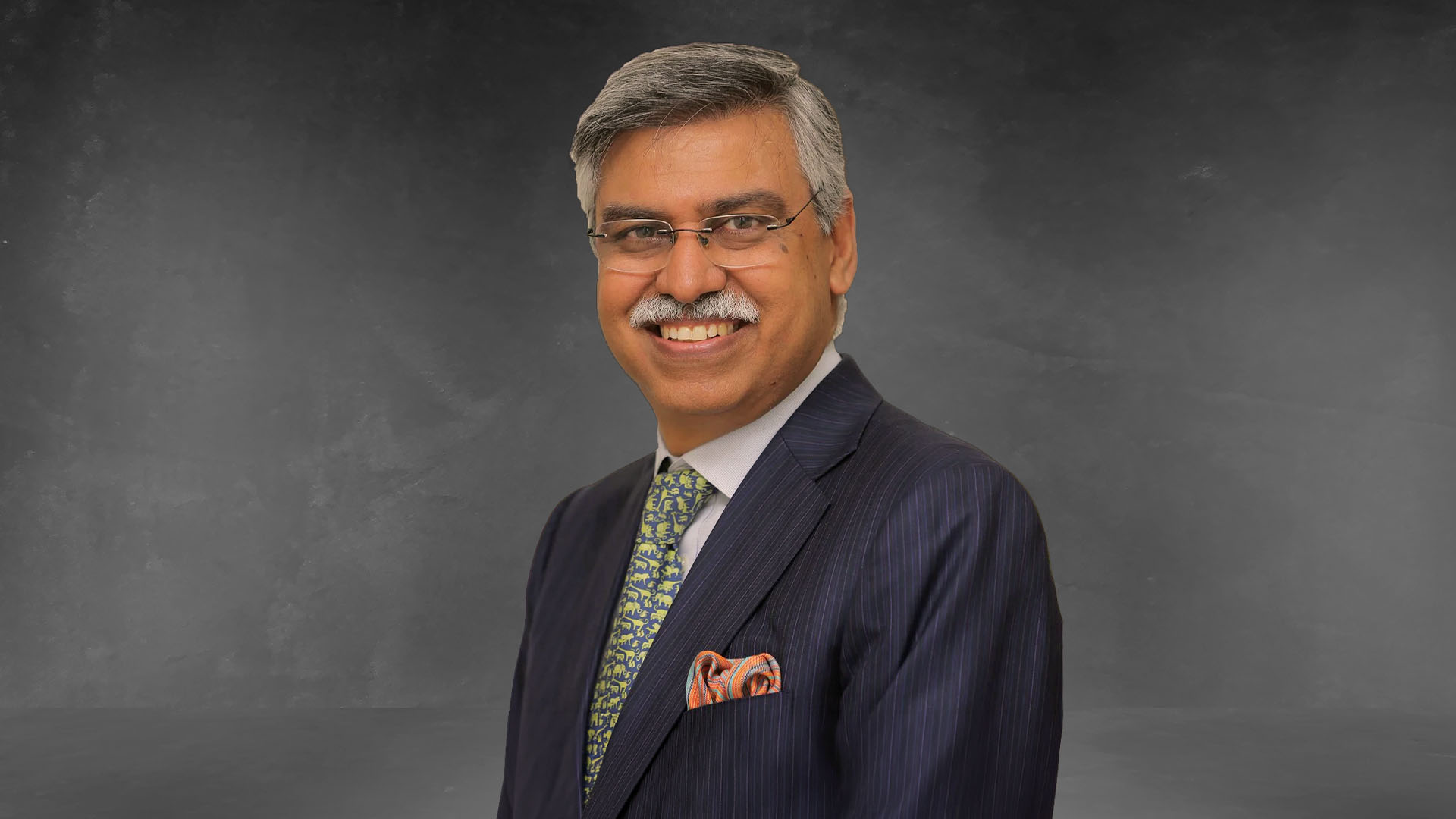

Ashish Jakhanwala, the visionary Managing Director and CEO who founded SAMHI Hotels in 2010, has crafted a bold playbook. His strategy? Transform India’s hospitality landscape by focusing on institutional investment and an acquisition-driven growth model, targeting prime metropolitan cities.

By Deepali Nandwani

Ashish Jakhanwala, Founder, MD, and CEO of SAMHI leads India’s pioneering hotel investment company—the first to break the mould as an institutional investor in the sector. Known for being sharp, witty, and driven, Jakhanwala heads a portfolio of 34 hotels. He’s worked across almost every department and role—operations, design, F&B—a hospitality veteran who’s been in the business so long, he probably dreams in RevPar stats.

He may call what he does ‘boring’—unlike the more glamorous corners of hospitality—but SAMHI’s portfolio tells another story. A self-professed data nerd, Jakhanwala’s secret sauce lies in his acquisition-led strategy—like playing Monopoly with real hotels. It’s a strategy that has earned the backing of big-league investors, including GTI, Equity International, IFC Washington, Goldman Sachs, and Sam Zell’s Equity International.

The Q4 FY ’25 results tells us how far SAMHI has come. Its Total Income for FY ’25 (Trinity consolidated w.e.f October ’24.) is ₹11,487 million, while EBITDA (pre-ESOP) is ₹4,434 million.

In this candid interview, he talks about his journey, why he’s bullish on India’s growth, and why going public is a means to an end—not a headline. For him, an IPO may be a good way to grow, but the focus must always remain on the ‘growth,’ not the buzz.

What got you into the hotel industry at a time when it wasn’t as vibrant as it is today?

I joined a hotel school in 1996. Honestly, there wasn’t much strategy or planning behind it. Before that, I did my schooling in the mountains of Uttarakhand. There were pros and cons to studying in the hills—especially in the early ’90s. You’re somewhat cut off from the rest of the world.

So when you come to a city, you're a blank slate. No biases about becoming an engineer, doctor, or anything else. The downside is you're a bit unexposed, if I may say so—but the upside is, you have no preconceived notions.

After finishing school, I moved to Lucknow. I happened to see an ad for hotel school admissions, applied, got selected, and went on to do three years of hotel management. I graduated from IHM Lucknow in 1996.

Back then, a hotel management graduate almost always started in hotel operations. Things have changed now—graduates go into retail, consulting, and other industries—but in 1996, you were headed for a hotel job.

I began as a management trainee at The Claridges in New Delhi and worked there for about two years. During that time, I realised I wasn’t cut out for operations.

I trace that back to growing up in the mountains—a place that makes you introspective. No TV, no distractions, no malls—just time to think. But hotel operations is a live-wire job. You're constantly on your feet, with little time to pause.

After two years, I knew I needed to do something else. So I moved into hotel facilities planning. From 1998 to 2002, I worked with the legendary Narendra Varma, who had headed development at Oberoi Hotels and was part of the team that built several Oberois, including those in South Bombay.

Though trained in operations, I started learning hotel design—both conceptually and technically. I learned AutoCAD and could draw entire hotels—electrical, plumbing, kitchen, and laundry layouts.

Having worked in operations helped me approach design with a practical lens. I had already left operations and effectively burnt that bridge, so I had to find a new path.

Around that time, I also began my Executive MBA at IIM Delhi. However, I questioned whether I could rise in such a technical role without being an engineer. Since I was doing an MBA, I started exploring other opportunities.

That’s when I joined PKF—Pannell Kerr Forster—a hospitality advisory firm led by the fabulous Uttam Dube, who now consults with Manav (Thadani) at Hotelivate. He’s someone many in the industry hold in high regard. I spent two years at PKF, learning the business side of hospitality: consulting, Excel modelling, forecasting, strategy, PowerPoint—you name it.

By then, I had experience in operations, design and planning, partial MBA credentials, and consulting. In 2004, Uttam was joining a new JV between Accor and InterGlobe and asked me to come help build the company.

So I joined in 2004. Until the end of 2010, I was part of the core team at Accor Hotels India. I played a key role in building what is now the ibis Hotels network for InterGlobe. I also worked on transactions like the Sofitel Mumbai and led the acquisition of the land for what is now Novotel and Pullman at Delhi Airport.

Those seven years were an incredible journey—deploying capital to build hotels. By the time I left, I had secured 17 ibis deals, a few Novotels, and the Pullman—a total of 25 transactions.

So from 1996 to 2010—14 years—I worked across operations, facilities planning, consulting, and development. The only thing left was to become an entrepreneur. In 2011, I founded SAMHI. And it’s been a good 14 years since then.

SAMHI acquired what is now Hyatt Regency Pune from Ascent Hotels for ₹350 crore, and brought in Hyatt Group to manage. Renaissance Ahmedabad offers 29,220 sq.ft. of indoor and outdoor flexible and modern REN meeting and events spaces.

I started with GTI, founded by Gaurav Dalmia, who remained an investor until just last month. Then we brought in Sam Zell—revered in the U.S. as the Warren Buffett of real estate. When you have investors like that, it’s like attending Harvard at every board meeting. Their experience, insight, and relationships bring enormous value. My advice to any entrepreneur is this: when starting or growing a business, don’t chase valuation—focus on the quality of your investor.

Ashish Jakhanwala

Managing Director & CEO, SAMHI Hotels

What inspired the transition from your role at Accor-InterGlobe to starting SAMHI? You've touched on that—but what was the experience like during your time there? How did it shape your vision for SAMHI?

That period was transformational for many reasons. While I wasn’t leading the business at Accor-InterGlobe, I was part of it—and had a ringside view of how a business is built. The joint venture was rich in talent, especially on the people side.

Take someone like Gaurav Bhushan, now co-CEO of Accor Lifestyle Hotels—he was my immediate boss at the time. He was based in Singapore; I was here. Then there was Rahul Bhatia, now best known for IndiGo. Having the chance to observe such people firsthand is incredibly inspiring. It shows you the headroom is infinite—that there’s always space to grow. It also nudges you to think about building something of your own.

And honestly, inspiration often comes from the smallest things. I don’t really believe in ‘Eureka’ moments—though I know they happen for some. For me, change has always come through gradual shifts in perspective, shaped by the small stimuli around me.

Over six or seven years, I was constantly learning. We were doing a lot of greenfield development, and as you know, not all of it went smoothly. Delays, roadblocks—that’s the nature of greenfield. Even when the decisions aren’t entirely yours, those challenges weigh on you if you’re an honest professional. You follow a set strategy, but you still learn—what works, and what doesn’t.

The people I worked with were phenomenal. It’s rare to encounter such talent in one lifetime. I also had the opportunity to make several investments. You need the courage to take bold calls.

Thankfully, I had bosses who encouraged that kind of risk-taking. They were patient, even when things didn’t go as planned. That sort of environment conditions you well—it teaches you to take calculated, meaningful risks.

If I look at my earlier experiences—at The Claridges New Delhi with Mr. Narendra Varma, or with PKF—those years were about learning the technical aspects: operations, design, feasibility. The Accor phase was about personal evolution.

I divide my career into two broad phases. The first—from 1996 to 2004—was all about skill-building. The second—from 2004 to 2011—was when I truly evolved as a person. I built confidence, developed relationships, and drew inspiration from visionary entrepreneurs like Rahul Bhatia.

Those two phases defined me. And it was that second phase—my time at Accor-InterGlobe—that gave me the confidence to start what is today SAMHI.

Ashish believes that the people he worked with were phenomenal. It’s rare to encounter such talent in one lifetime.

What did you learn about the hotel industry while setting up SAMHI? And what challenges did you face as a first-time entrepreneur?

By the time I started SAMHI, I had already learned many key lessons. And let me tell you—it’s a freakishly difficult business. Whatever can go wrong, will go wrong. Hotel development in India is extremely painful and unpredictable.

If you look at the landscape in 2010, hotels in India were largely owned by brands themselves—like Oberoi, ITC, Lemon Tree—or by real estate developers such as the Rahejas, Sarafs, or Jatias. To their credit, many of these developers have since evolved into institutional players. But back then, they were still primarily real estate-focused firms dabbling in hospitality.

Globally, the model is different—hotels are typically owned by institutional investors. I saw an opportunity to replicate that model in India: to build a platform that could attract institutional capital and become the country’s first large-scale institutional hotel ownership company.

That was the pitch I made to my first set of investors. The simplicity of the message—combined with the credibility I had built in previous roles—helped a lot. I managed to bring in what many would call jaw-dropping investors at the time.

I started with GTI, founded by Gaurav Dalmia, who remained an investor until just last month. Then we brought in Sam Zell—revered in the U.S. as the Warren Buffett of real estate.

When you have investors like that, it’s like attending Harvard at every board meeting. Their experience, insight, and relationships bring enormous value. That’s why my advice to any entrepreneur is this: when starting or growing a business, don’t chase valuation—focus on the quality of your investor.

Valuation matters only when you're selling 100% of your business. That’s when you aim for the best number. But in the build or grow phase, a great investor—even at half the valuation—can help you create twice the value over time.

That’s how we began. We had the right investors. We kept the message simple and stuck to it. We weren’t trying to do 20 things. We didn’t want to build a brand or manage hotels. We weren’t trying to be clever or flashy. We just wanted to be a predictable, plain-Jane investor in branded business hotels run by third-party operators.

And 14 years later, we’re still not bored of that philosophy.

Renaissance Ahmedabad offers 29,220 sq.ft. of indoor and outdoor flexible and modern meeting and events spaces.

Having the chance to observe such people firsthand is incredibly inspiring. It shows you the headroom is infinite—that there’s always space to grow. It also nudges you to think about building something of your own.

Ashish Jakhanwala

Managing Director & CEO, SAMHI Hotels

You continue to be investors rather than brand creators. Have you never seriously considered building a hotel brand?

Well, have I thought about it? Sure. But honestly, the thought doesn’t last more than 160 seconds. Running hotels—and more importantly, hotel brands—has reached a scale today where, for a company like ours—and let me clarify, I’m not putting us down—but for any subscale company in India, who are we kidding? Brands are best built by behemoths like the Taj, Marriott, Oberoi and ITC.

A real hotel brand today means 400 hotels, a couple of million rooms, loyalty programs with tens of millions of members, and global distribution across 100 countries. That’s what defines a brand. The name of a building? That’s just an address—not a brand. A true brand stands for scale, recognition, loyalty, and consistency—and that takes decades to build.

So, while creating a brand might sound exciting, we’re clear about who we are. We’re impatient for results, deeply focused on scalability, and fairly unforgiving when it comes to performance and returns. And when you put that together, the answer becomes obvious. India offers operating leverage. It offers growth. I’d much rather be an owner keeping 85% to 90% of the revenue than a brand earning just 5%. I’ve never wanted to work for that little compensation.

The Courtyard by Marriott Bengaluru Outer Ring Road is strategically located in Bellandur, Bangalore, near the bustling IT hubs of Marathahalli and Outer Ring Road (ORR), and blends luxury and functionality.

Marriott was your first transaction partner. How did that deal come about, and how has your relationship with Marriott evolved since? Also, didn’t you bring Fairfield to India?

Marriott came on board very early. I started the company in January or February 2011, and by March or April of that same year, we’d announced a joint venture with them. Under that partnership, Marriott committed up to $30 million for a 33% stake in our platform, to introduce and develop the Fairfield by Marriott brand in India.

It was Marriott’s first capital commitment with any owner in India—a significant milestone. Through that JV, we developed the Courtyard and Fairfield in Bangalore. Over time, we began developing more hotels on our balance sheet, and around 2016–17, we bought back their 33% stake.

But I think both sides achieved what we set out to do. Marriott’s goal was to catalyse Fairfield’s growth in India—and we did that. Today, Fairfield is a well-recognised brand in the country. We remain its single largest owner in India, even though there are now other owners as well. Marriott’s exit and our continued expansion of the brand are, in many ways, a textbook example of how a strategic partnership can evolve successfully.

Since then, our relationship has strengthened. Today, we have a large and diverse portfolio with Marriott. If I’m not mistaken, we’re the single largest owner of Marriott-operated hotels in India, with 17 properties across brands like Fairfield, Four Points, Courtyard, Sheraton—and now adding W and Westin. It’s a strong partnership with a company we truly admire. Marriott is a global leader, and being a relevant partner for them in India is immensely valuable.

We also have strong relationships with IHG and Hyatt. While Holiday Inn Express existed in India before us, for IHG, we brought in a portfolio of 10 hotels and converted them all at once. Today, we own about 60–70% of all Holiday Inn Express hotels in India. And we have two Hyatt hotels in Hyderabad. So yes, we’ve built some strong, enduring partnerships across the board.

He doesn't believe in ‘Eureka’ moments. For him, change has always come through gradual shifts in perspective, shaped by the small stimuli around him.

You’ve always focused more on value-for-money projects than luxury. Do you think luxury is harder to scale, or is the bigger opportunity in the mid-market segment?

Not exactly. If you look at our current revenue mix, about 45% comes from the upscale segment and 55% from mid-scale. Three years from now, I estimate it’ll be about 60% upscale and 40% mid-scale.

We’ve always loved the mid-scale segment. Yes, we’re the dominant owner of Fairfield by Marriott and Holiday Inn Express in India. But what’s interesting is that despite being the largest owner of those brands, they’ll only contribute about 40% of our revenue going forward. The other 60% will come from our upscale portfolio—brands like W, Westin, Courtyard, Sheraton, Renaissance, Hyatt Regency, and Hyatt Place.

So, I wouldn’t say we have a segment bias. We’ve always said we love markets more than we love segments.

For example, if we like Outer Ring Road in Bangalore, we’d want a Holiday Inn Express, a Fairfield, a Courtyard, and even a W there. Similarly, if we like Hyderabad as a market, we want to be present across multiple price points in that city.

Known for its proximity to the U.S. Consulate and tech hubs, Sheraton Hyderabad is ideal for business travellers.

Which markets do you think are performing well right now—or which ones show potential over the next 10 years?

In India, it’s never about the plan—it’s about execution. Cities like Hyderabad, Bangalore, Delhi, Mumbai, and Pune are fantastic markets, growing rapidly due to expanding office spaces and a booming airline sector.

The leisure segment is also doing well. Rising disposable incomes, better transportation networks, and a growing willingness to spend on high-end vacations suggest that demand for experiential leisure will grow disproportionately—possibly even multifold from where it is today.

While we don’t currently have a presence in leisure, we clearly see the opportunity. So far, our focus has been on core office markets and business hotels, where we already have a strong footprint.

Over the longer term, we expect some Tier 2 and Tier 3 cities to reach the kind of scale we now see in metro micro-markets. For instance, Whitefield in Bangalore has comparable hotel demand to an entire Tier 2 city like Coimbatore. These emerging cities could eventually match metro submarkets in hotel supply and performance.

That said, we’re not quite ready to invest heavily in Tier 2 and 3 cities today. But we know that as India grows, new kinds of opportunities will emerge. We need to stay agile and honest—never get myopic about what we’ve been doing. As long as the board and management stay responsive to change, companies like SAMHI will keep growing for the next two or three decades.

For now, our focus remains on business hotels in core office markets—and that likely won’t change for the next 24 months. But we’re closely tracking the evolution of the leisure space and the potential for Tier 2 cities to transition to Tier 1. It’s not unlike how private equity works—some investors focus on mature markets, others bet on emerging ones poised for transformation.

India is attracting substantial global capital because investors believe we’re on track to shift from a low-income to a middle—and eventually a high-income economy. Getting into pole position early in that transition can yield multifold returns from relatively modest investments. That’s the kind of forward-looking thinking we need when evaluating cities.

Will Ahmedabad break the mould and become a major metro? Will Coimbatore evolve into a mini metro? We’ve made early bets in Vizag, Coimbatore, and Ahmedabad—but about 80–85% of our revenue still comes from expected markets: Hyderabad, Bangalore, Pune, Delhi, and Chennai.

We’ve made small, strategic bets in emerging cities, hoping some break out and become mini metros. And there is growth—we’re seeing new businesses—but the scale is still smaller compared to cities like Hyderabad or Bangalore.

Let’s not forget, that India originally had just four metros: Delhi, Bombay, Madras, and Calcutta. In the late '90s and early 2000s, Pune, Bangalore, and Hyderabad were still considered mini metros. Fast forward 20 years and Bangalore and Hyderabad have surpassed Chennai and Kolkata in several ways.

In my view, the top four metros today are Delhi, Mumbai, Bangalore, and Hyderabad. The next three mini metros would be Pune, Kolkata, and Chennai. Eventually, I believe all seven will be major metros. In fact, Chennai and Kolkata are already undergoing significant transformations. Urbanisation will only accelerate—and that ensures Tier 1 markets will keep emerging. We won’t be short of cities where we’d want to build hotels.

The Fairfield by Marriott Chennai Old Mahabalipuram Road (OMR), an upper-midscale hotel located in Chennai’s IT corridor, was part of the 2017 acquisition of the Premier Inn India portfolio and subsequently rebranded to Fairfield by Marriott.

Your acquisition-led strategy has always stood out. Why did you choose that route over building new hotels from scratch?

Honestly, because I value my time. In family-run businesses, even if it takes five to ten years to build an asset, there’s comfort in knowing it will be passed on to the next generation. But I represent institutional investors. If I told them, “We’ll deploy capital today and see real value in six or seven years,”—well, they’d probably have better uses for their money.

That’s why we generally avoid greenfield development. There are too many variables—and any one of them can derail a project. I have a fiduciary responsibility to protect investor capital.

Also, India is still vastly under-penetrated in good-quality asset management—not just in hospitality. Look at what PVR did with cinemas. They went into city centres in Lucknow, and Kanpur, took over rundown theatres, transformed them—and suddenly, you had a glitzy PVR selling popcorn at ₹200–300.

So, if your goal is to build a scalable, capital-efficient company, acquiring and upgrading undervalued assets is a proven global strategy. We were the first to execute it at scale in India. Until four or five years ago, no one was really talking about buying hotels here. I’m glad we’ve helped shift that conversation. Today, more players are buying rather than building.

For us, the risk-reward ratio in acquisitions has always been more attractive. In nearly every case, we can buy a three-star hotel at a three-star valuation, invest in upgrades, reposition it as a four- or five-star property, and still keep our total cost well below what it would take to build the same hotel from scratch.

Essentially, we’re creating capacity at a discount to replacement cost—and that principle is central to our strategy at SAMHI.

So far, the focus has been on core office markets and business hotels, where they already have a strong footprint.

When you began SAMHI, was there a larger vision about the direction in which India’s hotel industry would head?

We’re talking about 2010—just the beginning of the industry’s emergence. It was clear even then that this sector would grow. Yes, there are cyclical ups and downs in performance, but structurally, we believed that if the Indian economy was going to grow, so would the hotel industry.

We also felt there was a need to bring in institutional capital and a structured approach. When you combine the scale opportunity in India with that kind of capital and discipline, we are confident in the strategy. And honestly, it has played out quite well. COVID was a temporary disruption, but beyond that, the strategy has worked.

We’ve built a company of scale. We’ve been in business for 14 years, and in terms of revenue, we rank as the sixth-largest. What’s notable is that among our peers with similar revenue, the youngest company is 28 years old—others are 33, 40, or even 50. So reaching this scale in just 14 years validates our acquisition-and-turnaround-led strategy.

Sam Zell—who was our shareholder for the longest time and a fantastic advisor—used to say, “Too much of a good thing is only wonderful.” Just because something’s been working doesn’t mean you need to change it. If it works, double down. And that’s exactly what we’ve done.

How do you select your brand partners? Is there a set of criteria?

We don’t approach it on a deal-by-deal basis. We build long-term partnerships, and keep the conversations open with potential new partners. The brands we work with must have a strong industry reputation, global distribution, robust loyalty programs, and a reliable, experienced team on the ground in India. We also ensure visibility into their hierarchy—right up to the top.

We typically don’t take chances with companies where we don’t have access to top leadership. But honestly, it’s not rocket science. We genuinely value and enjoy the partnerships we have.

Would you ever consider working with a new or upcoming brand?

I hope not. And I say that because it’s easy to get carried away. But we have a strong board that keeps me in check. We’re a board-driven company, and we’re clear that our hotels should be managed by operators with proven long-standing reputations.

We absolutely support new concepts and the entrepreneurial ecosystem—but not at the cost of putting our assets at risk. I manage third-party capital. Choosing an operator is one of the most critical decisions in the lifecycle of an asset. So we prefer to play it safe there.

You recently formed a joint venture with GIC for five hotels, valued at around ₹2,200 crore. How does that align with SAMHI’s long-term goals?

Hotel investments are highly capital-intensive, and this deal allowed us to solve several things at once. We had relatively high debt on our books, which limited the free cash available for growth—since much of it went to interest servicing.

By selling a 35% stake in three of those five hotels to GIC, we raised about ₹750 crore—of which roughly ₹600 crore went toward debt reduction. That frees up future cash flows, which we can now reinvest in growth. We now have GIC as a partner—an institution of great repute. In a 65:35 model, every ₹65 we invest could be matched by ₹35 from them.

That multiplies our capital and enables faster scaling.

Upscale hotels also demand significant investment—₹200, ₹400, sometimes ₹600 crore per property. Having a sovereign partner like GIC, with watertight governance and processes, adds both oversight and credibility. It’s a strong value addition.

We’ve known GIC for a long time—they’re a blue-chip, Grade-A partner. For many reasons, this was a milestone transaction for us.

There are cyclical ups and downs in performance, but structurally, he believed that if the Indian economy was going to grow, so would the hotel industry.

You went public in 2023. What was that experience like? How has it helped grow your business?

Taking a company public is like organising an Indian wedding. I often say we spend more energy on the wedding than on the marriage that follows. And going public isn’t all that different. Many promoters get excited about an IPO, but at its core, it’s just a means to raise capital.

The big difference is this—when a company is 100% promoter- or family-owned, it’s often run on their terms, with minimal external oversight. But once you’re public, it’s a different ballgame. You’re constantly answerable—investors watch closely, analysts ask tough questions and governance standards rise significantly.

In our case, though, we already had institutional capital from day one. We were operating with strong governance, rigorous reporting, and external scrutiny well before the IPO. So the transition to a public company was seamless. It wasn’t a dramatic shift, just a natural next step.

While many would consider an IPO a major milestone, to us it felt like part of a longer journey. Before going public, we had already raised capital from global names like GTI, Equity International, IFC Washington, and Goldman Sachs. The IPO was simply a continuation of that trajectory.

That said, running a public company is different. With a private company, you can take the occasional nap. With a public company, you can’t—you need to be alert and on your game 365 days a year. It forces sharper thinking and faster execution.

To any entrepreneur considering an IPO, I’d say: make sure you have the stamina to run—and keep running. Once you start, there’s no pause button. Either build that endurance yourself or create a leadership relay with a strong succession plan. But slowing down isn’t an option.

Do you think public markets are the way forward for the hospitality industry? Will more hotel groups go public to expand?

If the goal is genuine expansion, going public is a great move. But I worry some do it for fashion. It’s like dressing up for school in designer clothes—you’re meant to wear a uniform. Going public should be about substance, not style.

If you’re raising capital with the intent to grow the business profitably and deliver long-term value to shareholders, public markets are a fantastic platform. But if the motivation is to ride a trend or chase overnight wealth, that’s a shallow reason to access something I consider quite pure.

Yes, it’s a trading floor—but when you're dealing with public investors, you need to think like a public servant. You’re managing third-party capital. It’s not just your money. I always caution founders: only go public if you’re committed to building and growing the business over the next 10 to 20 years. If it’s just about catching a wave, it won’t end well.

We’re not quite ready to invest heavily in Tier 2 and 3 cities today. But we know that as India grows, new kinds of opportunities will emerge. We need to stay agile and honest—never get myopic about what we’ve been doing.

Ashish Jakhanwala

Managing Director & CEO, SAMHI Hotels

We’ve seen rapid investment and growth in India’s hospitality industry. Do you think this momentum is sustainable?

If India keeps running, we’ll keep running. As long as the economy grows—and I believe it will—the hotel industry will follow. If India stops, everything stops. We’re betting on India, and I think it would be foolish to bet against it. It’s a simple, binary bet, and I don’t want to be on the wrong side of it.

Look at global data—between 2024 and 2034, the travel and tourism sector is projected to grow at twice the rate of global GDP. That’s where my optimism comes from. If India maintains steady GDP growth over the next two decades, the hotel sector will grow at a multiple of that—whether 2x or 1.5x, time will tell.

What will really matter is execution and discipline. It won’t come down to a clever strategy or special intelligence. It will require simple, focused intelligence.

What advice would you give to young entrepreneurs entering India’s hospitality investment space?

This industry is both capital- and operations-intensive. Hotels empty out every day—and every day, you have to fill them again. That’s 365 days a year. It’s relentless.

Each hotel demands crores in investment. My advice: build experience first. This isn’t just a slippery slope—it’s a road without guardrails. One bad fall can be fatal. There’s too much capital at stake, and you need deep operational insight. No matter how smart you are or what your Harvard score was, hands-on knowledge will serve you better here.

Maybe I’m wrong—kids today are incredibly smart. But since you asked for advice, mine might be a little dated.

Looking back, is there anything you would have done differently in your journey with SAMHI? What’s the biggest lesson you’ve learned as an entrepreneur?

An entrepreneur’s life is full of mistakes. You could put me on every cover for two years and I would continue to talk about the mistakes and what we learned! And I’d wear those mistakes on my sleeve. They were honest mistakes. No regrets.

If I had to start SAMHI from scratch, I’m not sure I’d get here again. I don’t have a playbook that guarantees a better outcome the second time around.

But can I do better in the next 10 years? Absolutely. We’ve learned, and we’ve built strong teams, systems, and data. The building blocks are in place. That’s why I believe SAMHI is at a transformational point—we’re poised to double every four to five years.

Could I undo some mistakes? Sure. But I wouldn’t trade the wins: world-class investors, a team that’s stayed with us for 14 years, and operating partners like Marriott, Hyatt, and IHG who stood by us through thick and thin. I wouldn’t give any of that up just to fix a few errors.