Amritsar’s Golden Hue is Shining Ever Brighter

Amritsar, one of India’s leading religious and heritage tourism destinations and a key transit hub to the Himalayas, is strategically leveraging its strengths to boost its tourism market.

By Suman Tarafdar

“Welcome back after 28 years”.

That was the first sight that greeted me as I exited Amritsar airport. Its airport facilities notwithstanding, Amritsar is witnessing a spurt in growth. The city doubled its air passengers from over 10 lakh in 2015 to nearly 20 lakh in 2022 and is on track to double again within the decade, even drawing back long-lost progeny! Air traffic numbers are a good indicator. 2024 was the busiest year in the airport’s history, with total passenger traffic reaching 34.26 lakh. December 2024 also had the highest passenger traffic for a month at 3.40 lakh at Sri Guru Ram Das Ji International Airport, which is its official name. Incidentally, this was split between 23.12 lakh domestic and 11.14 lakh international passengers, making it the first time international traffic at the airport has crossed 10 lakhs in a single year. While the airport has seen a fluctuation in the number of flights connecting to main hubs of the Punjabi diaspora around the world—many still have to connect to their destinations from other Indian cities, mainly Delhi, and the number of direct flights is increasing. While most major global airlines do not currently have Amritsar on their roster, airlines such as Neos (connecting directly to Rome, Milan and Bergamo), Thai Lion Air (connecting to Bangkok), Scoot (Singapore), Malaysia Airlines and Batik Air Malaysia (KL), and lately Qatar Airways (Doha) are putting the city on the global aviation map.

Of course, Air India continues its direct connectivity to London and Birmingham, while its subsidiary Air India Express flies to Bangkok, Dubai, and Sharjah. Incidentally, this is the only international route for Indigo from Amritsar. And yes, the terminal upgrade is underway. Yes, increasing flights are feeding the growing number of hotels in the city. Easily the biggest draw in the city, the Golden Temple attracts an average of one lakh visitors per day, so much so that it effectively operates around the clock, with queues forming for darshan even in the wee hours of the morning. Amritsar was always a popular destination for pilgrims, but the extensive cleaning of the city in the previous decade, and the ₹250-crore Galliara Project, is credited with drawing in more tourists as it made access to the heritage city easier.

An emerging hospitality powerhouse

For a Tier II Indian city, the range of hospitality brands with a flag on the ground is astounding. A visitor could choose from the only Trademark Collection (Wyndham) in the country. Marriott already has three of its brands in the city and is expected to take to five soon with openings in the offing. ITC too has three, including the comparatively recent sprawling Welcomhotel by ITC Hotels. Radisson has two, as does Sarovar. Accor and Hilton are on track to open hotels. Many other groups, including Taj Hotels, IHG, Best Western, Royal Orchid and Treebo already operate hotels. The supply in the pipeline almost matches the current availability of branded rooms in the city, with even formats like long-stay residences coming up. According to a Colliers report, Amritsar has been witnessing an annual footfall of 30 million, and seeing a greater demand for branded hotels. Significantly, there is a huge number of independent hotels, some of which could be converted as the chains look to consolidate. The city traditionally known for divinity as well as kulchas, Amritsari macchi, juttis, phulkari and more, is now casting a wider net to attract a more diverse range of tourists.

SOH spoke to general managers of leading hotels of Amritsar to get an on-ground feel of where the city is headed, and how its hospitality sector is catering to it.

Many gather to witness the Beating Retreat Ceremony at the Attari border checkpoint at the India Pakistan border.

Amritsar has recently seen rapid growth in the branded hospitality segment. What factors would you ascribe to this move?

Naveen Yadav: Amritsar has always been a revered pilgrimage destination as well as a food lover’s paradise. It was under-penetrated in terms of quality hotels and branded accommodation. With better connectivity via road, rail and air, we have seen the demand for branded accommodation increase. From pre-COVID year-round occupancy rates of around 50%, the city has reached a year-round occupancy of approx 65–68%. With the upgradation work on the Amritsar airport as well as the Delhi-Katra expressway in the works, we foresee this demand to increase, creating the need for more branded accommodation. Amritsar also has a steady demand from the inbound segment as well as NRIs who visit the city.

Samir Pandita: No doubt Amritsar has seen many branded hotels opening in the last eight years, but the overall occupancies remain muted as the extra supply is absorbing the growth. Of all the factors which are of interest in Amritsar, The Golden Temple remains the top attraction, followed by Attari Border celebrations, which, over the years, have gained a lot of traction. Amritsar has various museums that are every tourist’s delight to visit. The laser show at the Gobindgarh Fort, Jallianwala Bagh in its new avatar, visit to various historical temples, shopping for ethnic wear, street food and some legendary food joints remain on top of the list for every traveller to The Golden City.

Ravi Dhankhar: Amritsar's rapid growth in the branded hospitality segment is driven by several key factors. Improved connectivity through its international airport has made the city more accessible, attracting global hotel brands. The emergence of modern attractions like Sadda Pind has transformed Amritsar into a well-rounded two-day destination, complementing traditional landmarks such as the Golden Temple, Jallianwala Bagh, and Wagah Border. Additionally, Amritsar is a preferred wedding destination, with luxury hotels catering to grand celebrations. Its strategic location as a transit hub for travellers heading to the Himalayas has increased the demand for quality accommodation. Effective marketing and tourism campaigns have further enhanced the city’s appeal. Amritsar’s spiritual significance as a holy city ensures a steady flow of pilgrims throughout the year, sustaining demand for branded hotels.

Abhilash Menon: Rising disposable incomes amongst the population of Amritsar and neighbouring cities such as Batala and Beas have led to a higher preference for branded hospitality experiences. Significant improvements in road infrastructure, tunnels, and elevated highways have reduced travel time, making Amritsar more accessible. Additionally, better air and rail connectivity have contributed to the rise in domestic and international tourism. Continuous government initiatives and beautification efforts around the Golden Temple, along with improved heritage conservation projects, have strengthened Amritsar’s appeal as a must-visit destination.The opening of the Kartarpur Corridor has increased cross-border tourism, attracting pilgrims and travellers from different regions. An increasing number of younger travellers are choosing branded hotels for their stays, preferring modern amenities, hygiene standards, and curated experiences.

Vijay Chandran: About nine-tenths of our guests are coming for religious tourism. Amritsar is growing a lot and many new brands have come in of late. However, the city needs a lot of rooms to handle a pharma or a banking conference, for example. Currently, the number of branded rooms would be somewhere around 2,200 rooms in the four and five star segments. Apart from this, there are enough rooms in Amritsar. We also expect around 800 rooms to be added this year.The more rooms are added, the better advantage for the city. We have A Four Points by Sheraton opening later this year, which will mean five Marriott hotels in Amritsar. In 2025, we are expecting a minimum growth of 10% over the previous year. I don't see any threat in having another 10 five-star hotels. When a new hotel opens, every general manager or owner even a brand that comes in creates more visibility for the city.

Almost 60% of our guests visit the city for religious purposes. With the addition of more branded hotels with MICE facilities as well as better connectivity, we have seen considerable growth in the meetings and conferences segment.

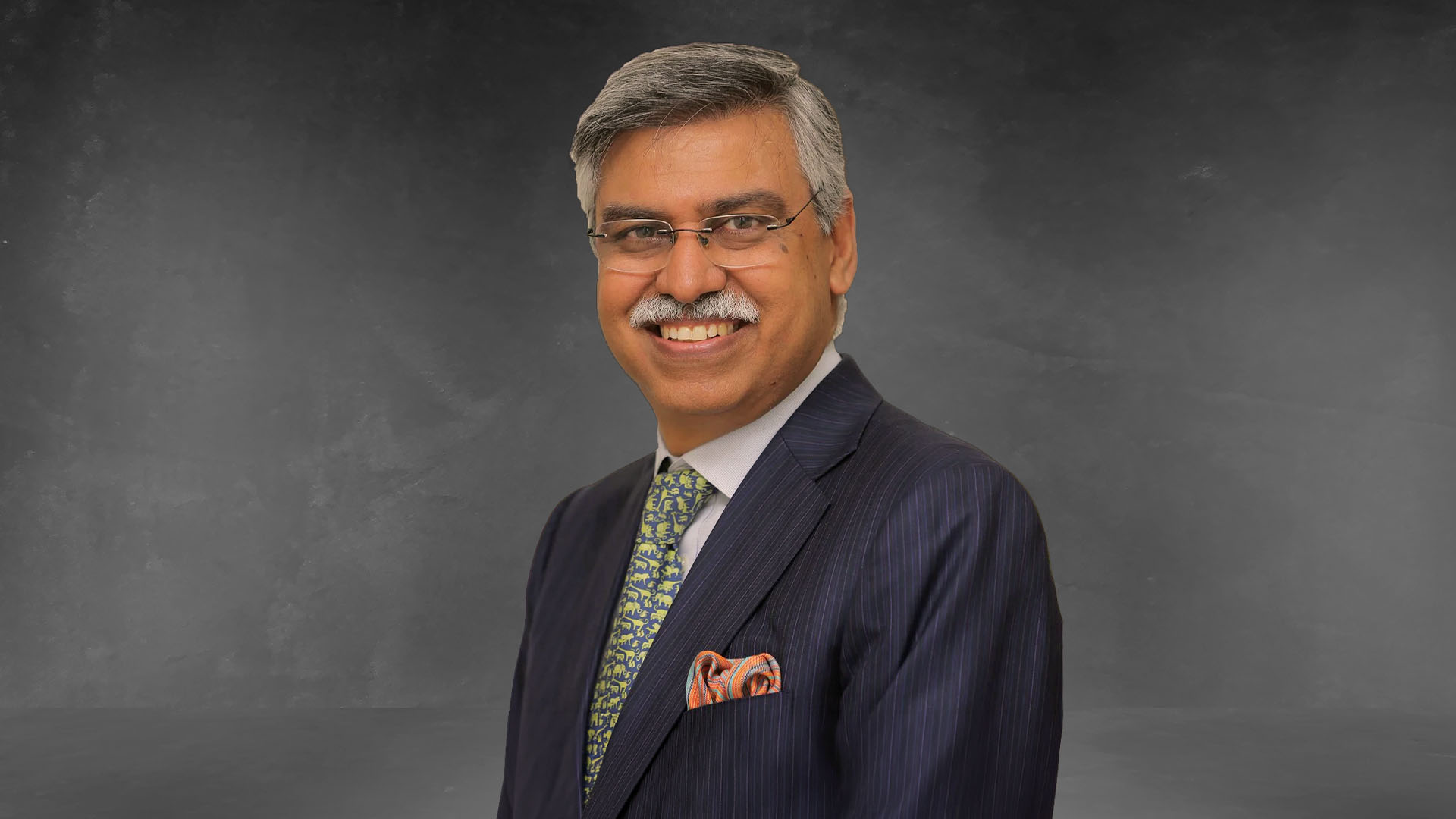

Naveen Yadav

General Manager, Hyatt Regency Amritsar

Amritsar is characterised by a high volume of religious tourism. Approximately what percentage of guests represents the religious or spiritual tourists? How are other segments growing?

Abhilash Menon: Religious tourism continues to be the dominant segment, with 70% of visitors travelling to the destination for religious purposes, primarily to visit the Golden Temple. 30% of guests belong to other segments, including leisure travellers—about 5% explore Amritsar’s historical and culinary experiences while social events, such as destination weddings, celebrations, and family gatherings, make up another 25%. Corporate events & MICE contribute about 10%. While religious tourism remains strong, leisure, social, and corporate travel segments are slowly growing, offering opportunities for further market diversification.

Samir Pandita: Almost 90% of tourists to the city are here for religious tourism. There may be others who come to the city to attend a wedding, or for official reasons (although very less), but even for them, the main attraction remains The Golden Temple. Although there are many experiences Amritsar requires to increase the pie, the city is choked with the current inflow of tourists and unless the government does something to upgrade the infrastructure, the pie cannot grow.

Ravi Dhankhar: Religious tourism remains the backbone of Amritsar’s hospitality industry, with approximately 70-75% of visitors coming to seek blessings at the Golden Temple. This ensures a steady influx of travellers year-round. However, the other segments that are growing rapidly include destination wedding tourism, heritage and cultural tourism, transit and leisure tourism, business and mice tourism and international tourism. While religious tourism dominates, these emerging segments are diversifying Amritsar’s hospitality landscape, fuelling its rapid growth.

Naveen Yadav: Almost 60% of our guests visit the city for religious purposes. With the addition of more branded hotels with MICE facilities as well as better connectivity, we have seen considerable growth in the meetings and conferences segment as well. Inbound tourism, too, has come back to an extent and is close to pre-COVID levels now.

The 248-key Hyatt Amritsar offers modern accommodations and facilities to visitors.

Hotels suffer due to poor air connectivity from feeder markets like Mumbai, Bengaluru, Ahmedabad, Kolkata and Hyderabad. The city also needs a larger convention centre which attracts large national and international conferences.

Samir Pandita

General Manager, Welcomhotel Amritsar

What are the main opportunities for growth for the city’s hotels? What steps would you suggest to increase travel to the city? And what are the top challenges?

Ravi Dhankhar: Enhancing air and rail connectivity will improve accessibility to the neighbouring states, attracting more domestic and international visitors. A single-window clearance system for hospitality projects will streamline investment, reducing bureaucratic delays. Additionally, infrastructural development, including better roads, public transport, and modern tourist facilities, is crucial. Government incentives will further encourage hospitality sector growth. However, challenges persist. A dedicated tourism police force is needed to enhance visitor safety. Local police should be lenient, welcoming, helpful, flexible and adaptable as compared to the law-and-order police. They should also be acquainted with multiple international languages, like French and Chinese. Hygiene and sanitation issues must be addressed with better waste management. Moreover, Amritsar’s rich cultural heritage remains under-marketed; stronger tourism campaigns are essential. By tackling these issues and implementing strategic improvements, Amritsar can evolve into a diverse tourism hub, attracting a broader range of visitors and boosting its economy. Amritsar’s hospitality sector is expanding beyond religious tourism with budget hotels, culinary tourism, and digital innovations enhancing guest experiences. Eco-friendly stays appeal to conscious travellers, while weekend trips and short getaways drive demand. Growing interest in experiential travel, workcations, and heritage stays is transforming Amritsar into a diverse destination, attracting visitors beyond pilgrimage tourism.

Samir Pandita: Since Amritsar airport is an international airport, it needs a larger airport to handle domestic as well as international flights. Hotels suffer due to poor air connectivity from feeder markets like Mumbai, Bengaluru, Ahmedabad, Kolkata and Hyderabad. The city also needs a larger convention centre which attracts large national and international conferences. Since Amritsar as a destination is very popular, the city has major potential to hold events/ conferences at that level. We also need political stability in the state. Travel by road or train has become very erratic due to the ongoing issues in and around the state. Visitors from Delhi NCR, Jaipur, Dehradun and other nearby towns prefer to travel with their families for vacations by car, but these agitations impact their travel plans.

Naveen Yadav: The city needs to work on improving tourism-related infrastructure. Airport upgradation is in the pipeline, but the government definitely needs to invest in the infrastructure to make it a tourist-friendly city. Proper marketing of tourism spots in and around Amritsar would also help. The Golden Temple and the Attari border are world famous, but there are a lot of other attractions in and around Amritsar, like Gobindgarh Fort, Ram Tirath temple, etc., which need more exposure and can help increase the length of stay for tourists.

Vijay Chandran: Amritsar is basically a leisure market with religious visitors dominating in terms of numbers. Hotels actively engage and court this segment. Every premium hotel offers a facility of a complimentary pickup and drop to the Golden Temple. And the same is true with the Attari border, which is an excellent attraction. Another popular spot is Pul Kanjri, which an increasing number of people are beginning to explore. A couple of museums are worth a visit, especially the war museum by the border. Our connectivity is a big advantage. Amritsar is the primary market for a stopover for tourists to Dalhousie, Dharamshala and Kashmir. The city acts as a perfect transit spot. We need to add more quality rooms to attract a larger MICE business. Branded hotels can cater to a maximum of 1,500-2,000 guests. We do not have a large convention centre, which can attract large events. More flight routes can be opened. There's no direct connectivity to many places apart from the metropolitan cities. Better connectivity to our main inbound source markets would also greatly help. Of course, our Marriott Bonvoy loyalty programme ensures a lot of visitors. The reach to our direct loyal guests continues to increase, driving enough traffic to our properties.

Abhilash Menon: There are many opportunities for the city to grow. This includes expanding beyond religious tourism and promoting Amritsar as a cultural, historical, and culinary destination that can attract a broader audience. There could be increasing demand for corporate meetings, incentive travel, and conventions present an opportunity to develop MICE tourism. Amritsar is emerging as a popular wedding destination, offering a blend of luxury, heritage, and cultural charm. There are several challenges, too. This includes seasonal demand fluctuations. While peak season (November to February) witnesses high occupancy, the off-season (May to August) poses a challenge for hotels. There is an over-reliance on religious tourism, the city needs to diversify its attractions to reduce dependency on a single tourism segment. The hospitality industry faces challenges in hiring skilled professionals with language and cultural training. There is competition from unorganised accommodations, and the rise of unregulated guesthouses and homestays affects the market share for branded hotels. Traffic congestion, parking shortages, and sanitation challenges near key tourist areas need to be addressed. Among the needed improvements are traffic management and parking solutions around the Golden Temple area. There also needs to be enhanced sanitation and hygiene initiatives in high-footfall zones. Equally important, international flight connectivity, particularly to markets such as the USA and Europe, needs to be improved.

Naveen Yadav, General Manager, Hyatt Regency Amritsar

Samir Pandita, General Manager, Welcomhotel Amritsar

Rising disposable incomes amongst the population of Amritsar and neighbouring cities such as Batala and Beas have led to a higher preference for branded hospitality experiences. Significant improvements in road infrastructure, tunnels, and elevated highways have reduced travel time, making the city more accessible.

Abhilash Menon

General Manager, Sarovar Premiere Amritsar

What are the top sources of tourists for your hotel, by revenue? What is the split between leisure/ FIT/ social events, business and MICE guests/events for your hotel? And between local and non-local guests?

Vijay Chandran: About 90% of our guests would fall in the leisure segment, including religious tourism and a miniscule of 5 to 6% is corporate or any other segment. When it comes to leisure, it's clearly defined by domestic travellers, who play a larger role. Indians travelling within India is the biggest market for us. For inbound, the top countries are the US, Canada, Australia, Korea, Japan and China. The inbound market contributes most during the season time, which is Q1 and Q4. Q2 and Q3 are predominantly summer and cater largely to the domestic market and a new segment of film crews. We are also seeing traction from European markets, beyond our core markets of the US, Australia, Canada and England, besides interest from Asian markets because of Dharamshala.

Ravi Dhankhar: Inbound agencies and online travel agencies (OTAs) play a crucial role in driving tourist inflow to our hotel. Leisure and FITs remain the dominant segment, contributing 55%-60% of total revenue. MICE and business travel collectively account for 27%, highlighting Amritsar’s growing appeal for corporate events and conferences. Social events, including weddings and celebrations, contribute 12%-15%, reinforcing the city’s status as a preferred wedding destination. In terms of demographics, our guest mix includes both local and non-local travellers, with a strong presence of domestic tourists alongside international visitors drawn by religious, cultural, and experiential tourism. Abhilash Menon: For our hotel, Online Travel Agencies (OTAs) are a major contributor, driving bookings from domestic and international travellers. Walk-in guests also form a significant share, given Amritsar’s strong religious tourism. Social events and weddings are an emerging revenue stream with increasing demand. Our guest mix is leisure (5%), FIT (70%), social events (10%), and MICE (15%).

Naveen Yadav: The biggest feeder market for us is Delhi NCR, followed by other cities like Chandigarh, and Ludhiana in Punjab. Approximately 60–65% of business is driven by the transient segment. The social segment has always been an important part of the Amritsar market and continues to grow. MICE has increased considerably in the last couple of years.

Samir Pandita: Over the years, we have depended majorly on FIT/ Leisure travel, however in the winter months we also receive a sizable number of guests who travel for weddings and other MICE events. Considering guests from Punjab as local and others non-local, the ratio is 25% to 75%.

Abhilash Menon, General Manager, Sarovar Premiere Amritsar

Ravi Dhankhar, General Manager, Holiday Inn Amritsar

Enhancing air and rail connectivity will improve accessibility to the neighbouring states, attracting domestic and international visitors. A single-window clearance system will streamline investment, reducing bureaucratic delays.

Ravi Dhankar

General Manager, Holiday Inn Amritsar

How would you rate the state’s policy for hospitality and tourism—and what would you like to see changed?

Ravi Dhankhar: Punjab's tourism and hospitality sectors have seen commendable government initiatives, with the Punjab Tourism Policy 2018 focusing on cultural preservation and promotion. However, improvements are necessary. Greater investment in marketing infrastructure can enhance Punjab’s visibility on national and international platforms. Additionally, relaxations and incentives for the hospitality sector, such as tax benefits and streamlined licensing, would attract more investors, fostering sustainable tourism growth.

Vijay Chandran: The tourism ministry spends adequate time, energy and money to promote the city. The state has launched several tourism-related activities, exhibitions and conventions such as MICE, travel agents’ and inbound market events. These multiple events are increasing visibility in the market.

Samir Pandita: The present government is trying to attract more tourists to the state through their various programmes, like ‘Rangla Punjab’. However, more needs to be done, particularly on improving the infrastructure in cities like Amritsar. The state government must make a case for increasing flights from feeder markets. The administration may want to analyse the growth trend in the number of weddings and MICE conferences across all categories of hotels.

Abhilash Menon: The Punjab government has been proactive in promoting tourism, making Amritsar one of India’s top-performing destinations with a daily footfall of 30,000–40,000 tourists. However, enhancing existing sites like Heritage Street, Partition Museum, and Gobindgarh Fort to provide immersive visitor experiences will help. Implementing stricter traffic regulations around the Golden Temple and major tourist areas as well as additional public restrooms, street lighting, and well-maintained pedestrian walkways, are needed.

Vijay Chandran, General Manager, Courtyard Marriott Amritsar

Amritsar's infrastructure is likely to strengthen. We have to reach new markets and make people aware that we exist and how beautiful the city is.

Vijay Chandran

General Manager, Courtyard Marriott Amritsar

Could you give us an idea of the trends for occupancy and ARRs in recent years—pre-COVID to post-COVID? By how much are ARRs up this year compared to recent years?

Abhilash Menon: Pre-COVID (2019), Amritsar’s hospitality sector thrived with consistently high occupancy, driven by both domestic and international visitors. During COVID (2020-2021), travel restrictions led to a sharp decline in occupancy, with hotels struggling to maintain profitability. Post-COVID (2022-2023) as travel resumed, occupancy rates steadily increased, driven by religious tourism, staycations, and local travel. The ARRs pre-COVID (2019) was stable and reflective of the city’s strong demand. During COVID, it declined due to lower demand and aggressive pricing strategies. Post-COVID, ARRs rebounded with improved occupancy and higher demand for premium experiences. In 2024-25, rates have continued to increase, supported by high occupancy levels due to rising domestic and international travel and enhanced hotel offerings such as wellness experiences and curated food tourism.

Ravi Dhankhar: In recent years, Amritsar’s hospitality sector has shown steady growth in occupancy and ADRs. The city has maintained an occupancy rate of 65%-68% over the past couple of years, reflecting sustained demand. Post-COVID, the market has rebounded strongly, with ADRs increasing by 18% - 20% compared to pre-pandemic levels. This growth is driven by higher travel demand, improved connectivity, and Amritsar’s rising appeal as a diverse tourism destination.

Naveen Yadav: There has been a considerable increase in occupancy and ADRs post-COVID. Year-round occupancies have reached closer to 70% for branded hotel chains. ADRs, too, have kept pace with this increase in demand. 2023 was a big year with occupancy and ADRs growing in double digits and considerably higher than pre-COVID levels. Vijay Chandran: In the premium segments, the city ARR averages around ₹6,500. On certain days, the rates can top ₹10,000.

Samir Pandita: The city occupancy in the 5-star segment remains at 60% with ARR between ₹5,500 to ₹7,500. If you remove the COVID years, we have witnessed around 2-3% increase in the occupancy with about 15-20% increase in the ARR.

Courtyard by Marriott Amritsar offers contemporary rooms inspired by local artistry.

Welcomhotel by ITC Hotels, Amritsar, is Punjab's first LEED Platinum-certified retreat.

What are the top sources of tourists for your hotel, by revenue? What is the split between leisure/ FIT/ social events, business and MICE guests/events for your hotel? And between local and non-local guests?

Vijay Chandran: About 90% of our guests would fall in the leisure segment, including religious tourism, and a minuscule of 5 to 6% is corporate or any other segment. When it comes to leisure, it's clearly defined by domestic travellers, who play a larger role. Indians travelling within India is the biggest market for us. For inbound, the top countries are the US, Canada, Australia, Korea, Japan and China. The inbound market contributes most during the season time, which is Q1 and Q4. Q2 and Q3 are predominantly summer and cater largely to the domestic market and a new segment of film crews. We are also seeing traction from European markets, beyond our core markets of the US, Australia, Canada and England, besides interest from Asian markets because of Dharamshala.

Ravi Dhankhar: Inbound agencies and online travel agencies (OTAs) play a crucial role in driving tourist inflow to our hotel. Leisure and FITS remain the dominant segment, contributing 55%-60% of total revenue. MICE and business travel collectively account for 27%, highlighting Amritsar’s growing appeal for corporate events and conferences. Social events, including weddings and celebrations, contribute 12%-15%, reinforcing the city’s status as a preferred wedding destination. In terms of demographics, our guest mix includes both local and non-local travellers, with a strong presence of domestic tourists alongside international visitors drawn by religious, cultural, and experiential tourism.

Abhilash Menon: For our hotel, Online Travel Agencies (OTAs) are a major contributor, driving bookings from domestic and international travellers. Walk-in guests also form a significant share, given Amritsar’s strong religious tourism. Social events and weddings are an emerging revenue stream with increasing demand. Our guest mix is leisure (5%), FIT (70%), social events (10%), and MICE (15%).

Naveen Yadav: The biggest feeder market for us is Delhi NCR, followed by other cities like Chandigarh and Ludhiana in Punjab. Approximately 60–65% of business is driven by the transient segment. The social segment has always been an important part of the Amritsar market and continues to grow. MICE has increased considerably in the last couple of years.

Samir Pandita: Over the years, we have depended majorly on FIT/ Leisure travel; however, in the winter months, we also receive a sizable number of guests who travel for weddings and other MICE events. Considering guests from Punjab as local and others non-local, the ratio is 25% to 75%.

The Partition Museum gives voice to the tragedies of partition.

An erstwhile military establishment, today Gobindgarh Fort, is a top level tourist attraction.

What is the tourism potential of Amritsar looking like in the next few years, especially beyond religious tourism?

Ravi Dhankhar: Amritsar’s tourism potential in the coming years looks highly promising, with significant opportunities beyond religious tourism. One major area of growth is the MICE sector. With improving infrastructure, an expanding hospitality landscape, and a growing number of luxury hotels, Amritsar is becoming a viable destination for corporate events, large-scale weddings, and exhibitions. If the government invests further in developing world-class convention centres and business hubs, the city could attract more corporate travellers and high-profile events. Additionally, the IT sector is gaining traction in Punjab, and Amritsar has the potential to become a secondary hub after Mohali. With better connectivity and business-friendly policies, the city could see an influx of professionals and entrepreneurs, indirectly benefiting its tourism and hospitality sectors. To fully capitalise on this potential, strategic marketing, infrastructure development, and investor-friendly policies will be essential.

Abhilash Menon: The city is well-positioned to grow as a multi-dimensional tourist hub. Wellness tourism could rise with the introduction of spa retreats and Ayurveda-based wellness centres. Cycling tours, trekking, and cultural trails raise the prospect of more adventure tourism: Promoting visits to the Partition Museum, historic sites, and academic institutions could promote educational tourism. Amritsar’s food culture—dishes like Kulcha, Lassi, and Amritsari Machhi—is gaining global recognition and can be promoted to increase culinary tourism.

Samir Pandita: Unless the above-mentioned issues are addressed, the actual numbers may not grow. The Golden Temple will remain the main attraction for tourism in Amritsar and other sectors may also grow, but the primary reason for any MICE or wedding in the city remains Darbar Sahib.

Naveen Yadav: Amritsar has a lot of potential for tourism over the next five years. The government needs to work closely with the industry to understand and address the issues faced by us as well as the tourists. Tourist attractions need to be marketed and the infrastructure around them improved. Food is a big part of the culture here and can definitely help in increasing tourist footfalls.

Vijay Chandran: Amritsar has a promising future. The city’s infrastructure is likely to strengthen. The marketing and promotion will help travellers know a lot more about the city, and the facilities and opportunities it offers. We have to reach new markets and make people aware that we exist and how beautiful the city is. Creating new segments will help Amritsar thrive. A new cricket stadium, concert venues, an additional trade centre, maybe a couple of great colleges for higher education, medical colleges, for example, all of this infrastructure can help the city grow. As and when the city's infrastructure grows, our business will grow alongside. Otherwise, we predominantly have to survive on tourism.

The Holiday Inn brings the brand’s contemporary flair to the city.

There are splendid examples of colonial era architecture in Amritsar, such as the erstwhile Town Hall seen here.