The Hotel Boom That Refuses to Slow Down

India’s hotel sector may be entering a new era as it breaks the cyclical nature of its growth with record revenues, bold partnerships, and a new trajectory.

By Suman Tarafdar

One of the enduring paradigms of Indian hospitality over the past few decades has been the strong sense of circularity. “2024 was great; we hope the trend continues,” confided a hotelier off the record at the end of that landmark year, which saw record occupancies and signings. Well, the crest hasn't yet been reached. The first half of 2025 is not just holding up, but it will go down in history as a landmark period for the sector.

Not only have most markets held onto their occupancies and rates, but what has been even more remarkable is the number of deals. Whether mergers or acquisitions, partnerships or strategic alliances, even signings—there has never been such a bounty. The launch of Marriott's Series, an India-first brand for the hospitality major, in collaboration with CG Corp Global, who have extensive properties around India, was a huge step, arguably making it the largest hospitality brand in India.

Accor’s strategic partnership with Treebo is just as significant, besides the restructuring of its corporate presence in India. Both alliances will offer these groups oppurtunities to penetrate the budget segment of India’s vast hinterland rapidly. Wyndham, the world’s largest hotel franchising company, has tied up with Cygnett for expansion. IHCL, meanwhile, announced its first in-house brand in years, also in a tie-up with The Claridges. In its latest quarterly report for Q1 2025-26, it announced the 13th consecutive quarter of record performance. Recently, IHCL has entered into a significant strategic partnership, signing agreements to acquire controlling stake in ANK Hotels Pvt Ltd and Pride Hospitality Pvt Ltd. The group has also signed a distribution agreement with Brij Hospitality Pvt Ltd, taking IHCL’s portfolio to over 550 hotels, the first for any group in India.

Despite India being on high alert, coupled with restrictions on movement, post the Pahalgam attack on April 22, rates largely held up in May. Numbers did fall slightly, but summer is also the slowest period for most of the sector in India, apart from the mountains and hills.

In what is perhaps the most exciting portent of what is to come for India’s hotel sector, it is not just growing—it’s evolving. Most significantly, the regular cycle of highs and slowdowns may finally be a facet of the past for Indian hospitality.

Here are some positive signs

- The hotel market in India is expected to witness a rise in revenue with a projected value of US$11.35bn in 2025.

- India’s hospitality industry reported a 16.3% increase in RevPAR in Q1 2025 compared to the same period in 2024, according to JLL. RevPAR also rose 8% from Q4 2024 across India.

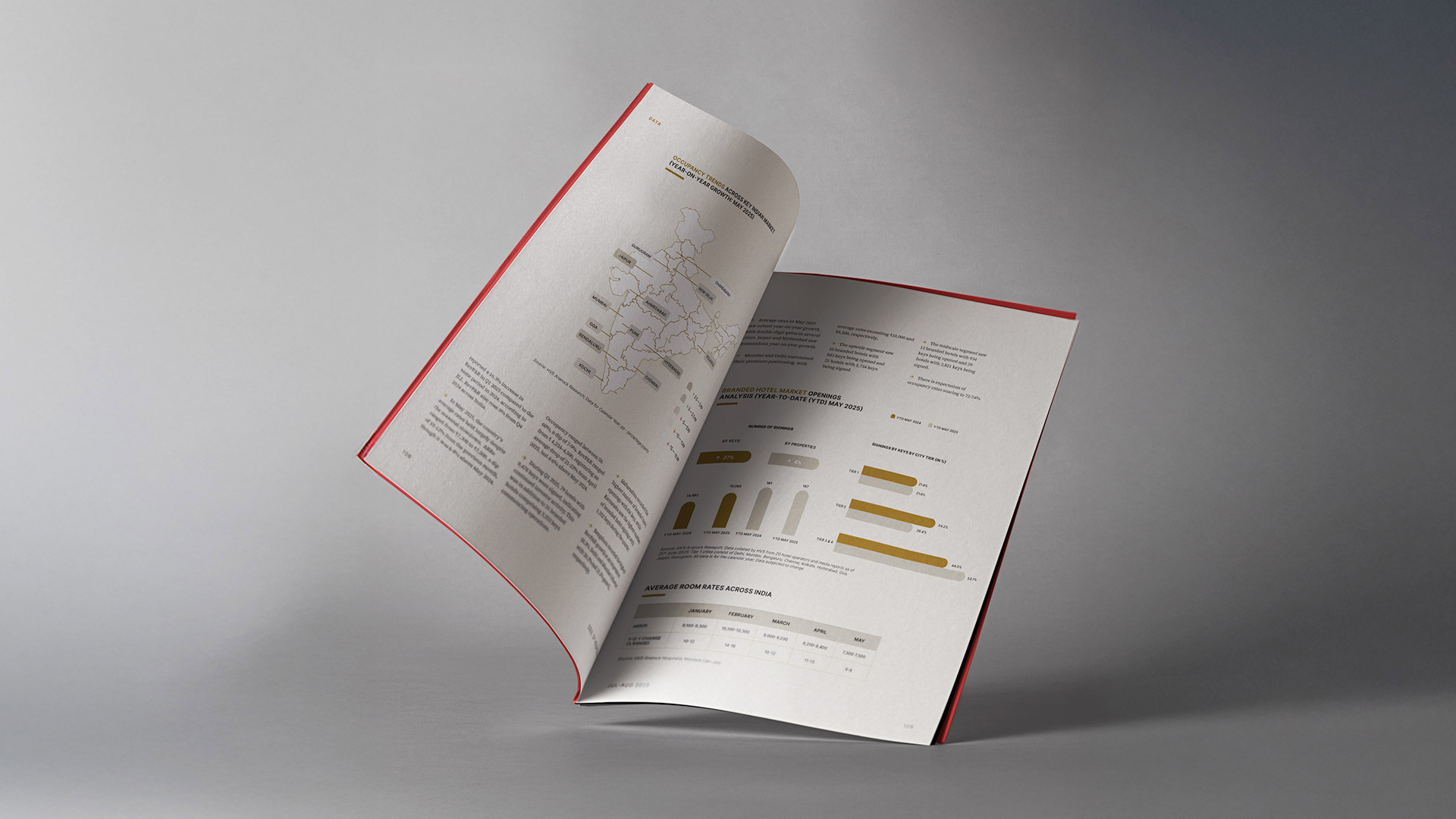

- In May 2025, the country’s average rates held largely despite the seasonal slowdown. ARRs ranged from ₹7,300 to ₹7,500, a dip of 10-12% from the previous month, though it was 6-8% above May 2024. Occupancy ranged between 58-60%, a dip of 7-9%. RevPAR ranged from ₹ 4,234–4,500, registering an average drop of 21-23% from April 2025, but 4-6% above May 2024.

- During Q1 2025, 79 hotels with 9,478 keys were signed, indicating continued investor activity. This was in addition to 31 branded hotels comprising 3,253 keys commencing operations.

- Maharashtra recorded the highest number of branded hotel openings with 836 keys, while Karnataka saw the highest number of branded hotel signings with 1,352 keys during the quarter.

- Bengaluru recorded the highest RevPAR growth at an impressive 38.3%. Delhi and Mumbai followed with 26.2% and 21.3% growth, respectively.

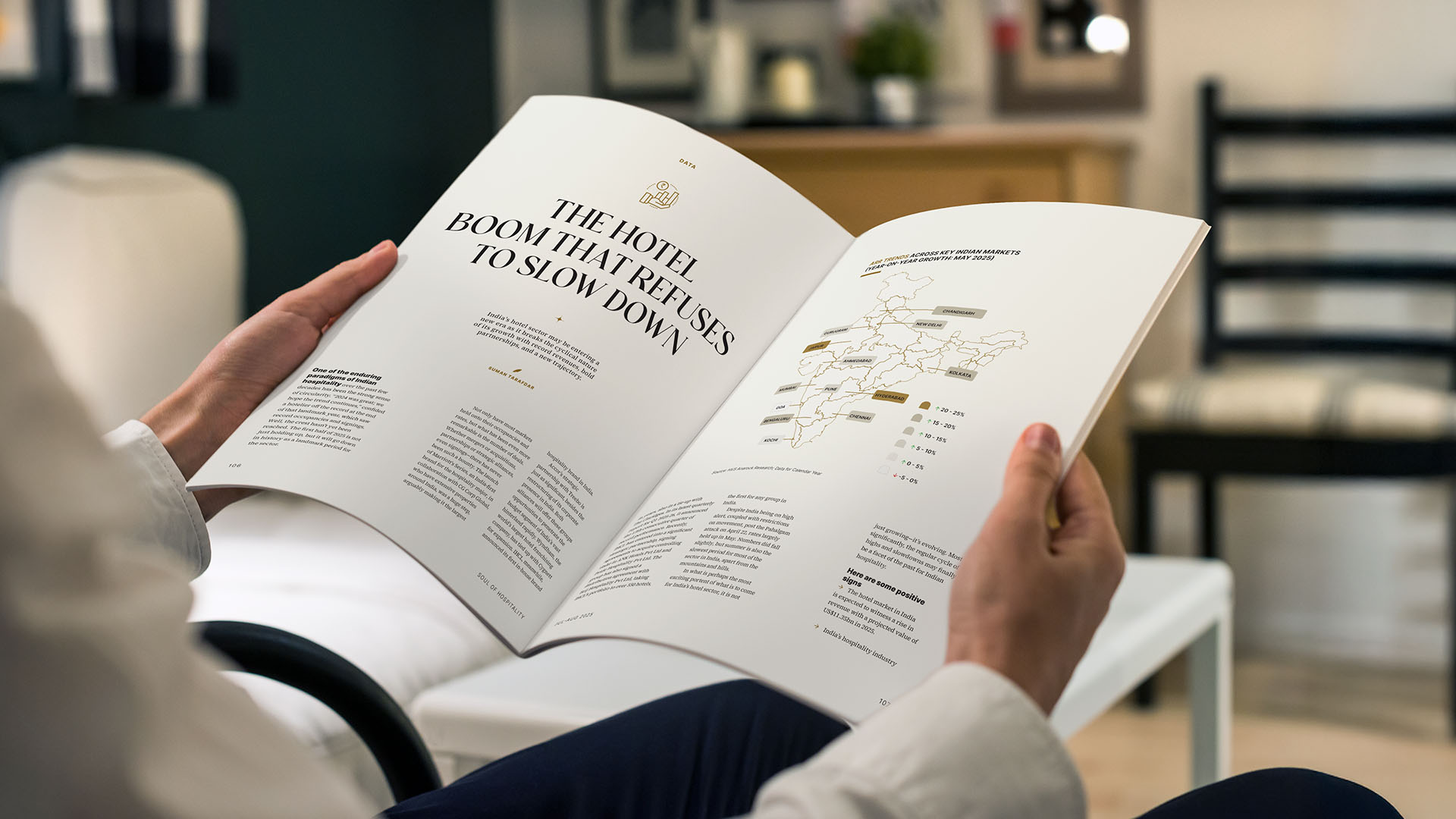

- Average rates in May 2025 saw robust year-on-year growth, with double-digit gains in several cities. Jaipur and Hyderabad saw tremendous year-on-year growth.

- Mumbai and Delhi maintained their premium positioning, with average rates exceeding ₹10,000 and ₹8,500, respectively.

- The upscale segment saw 10 branded hotels with 843 keys being opened and 21 hotels with 2,734 keys being signed.

- The midscale segment saw 12 branded hotels with 934 keys being opened and 29 hotels with 2,821 keys being signed.

- There is expectation of occupancy rates soaring to 72-74% by FY 2026, with premium hotels’ Average Room Rates (ARR) set to climb to ₹8,000-8,400.

- The market is expected to exhibit an annual growth rate of 16.59% (CAGR 2025-2030), contributing to a market volume of US$24.46 bn by 2030.

- The number of users in the hotels market is expected to reach 154.66 million by 2030, with a user penetration of 4.4% in 2025, which is expected to increase to 10.1% by 2030.

- The average revenue per user (ARPU) is expected to be US$174.91.

- It is projected that 61% of the total revenue in the hotel market will come from online sales by 2030.

The regular cycle of highs and slowdowns may finally be a facet of the past for Indian hospitality.