From Rebound to Resilience

Sustained domestic travel, strengthening corporate demand, disciplined supply pipelines, and diversified travel drivers are pushing India’s travel industry into a new phase of stable, long-term growth after years of volatility.

By SOH Team

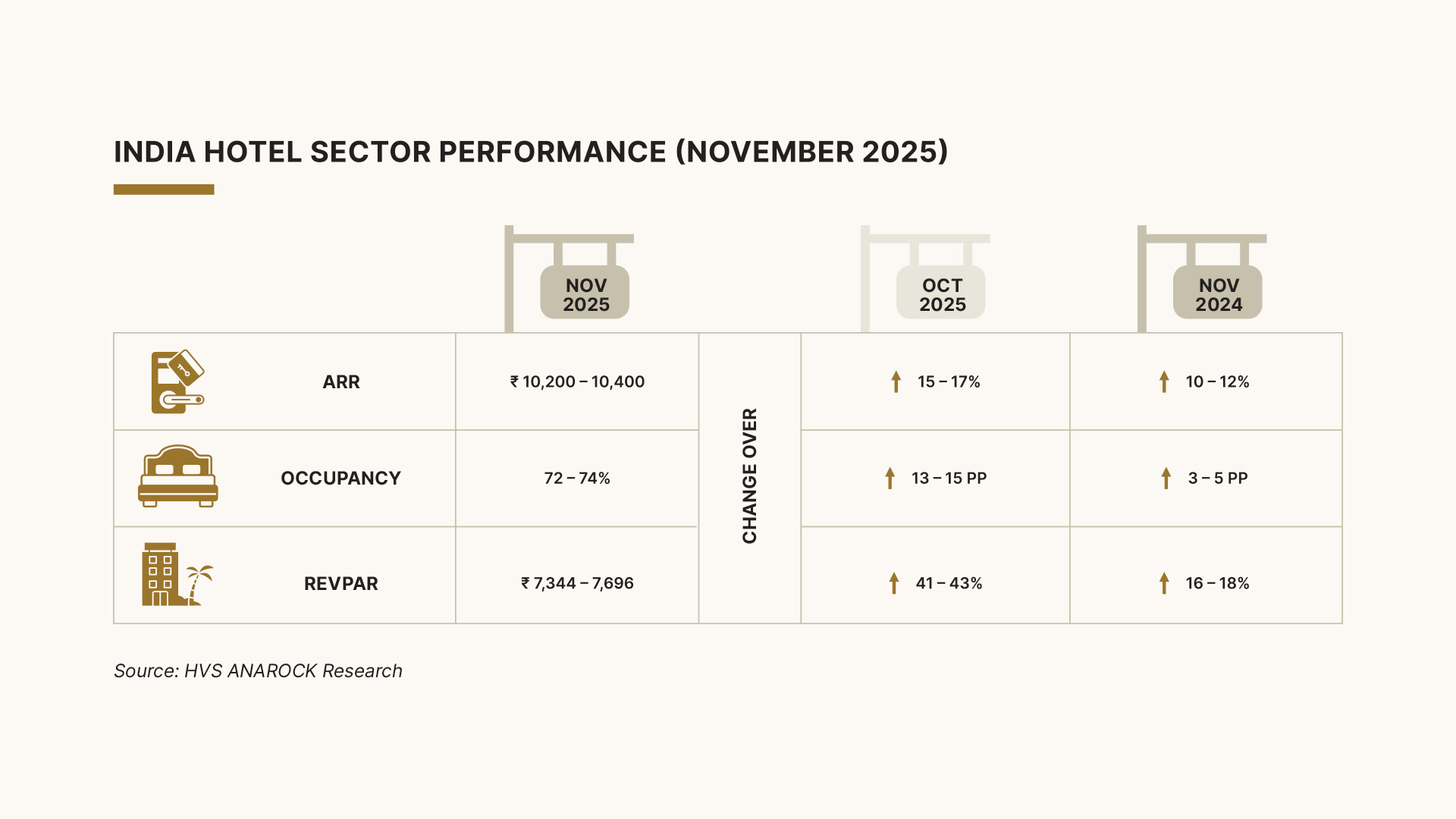

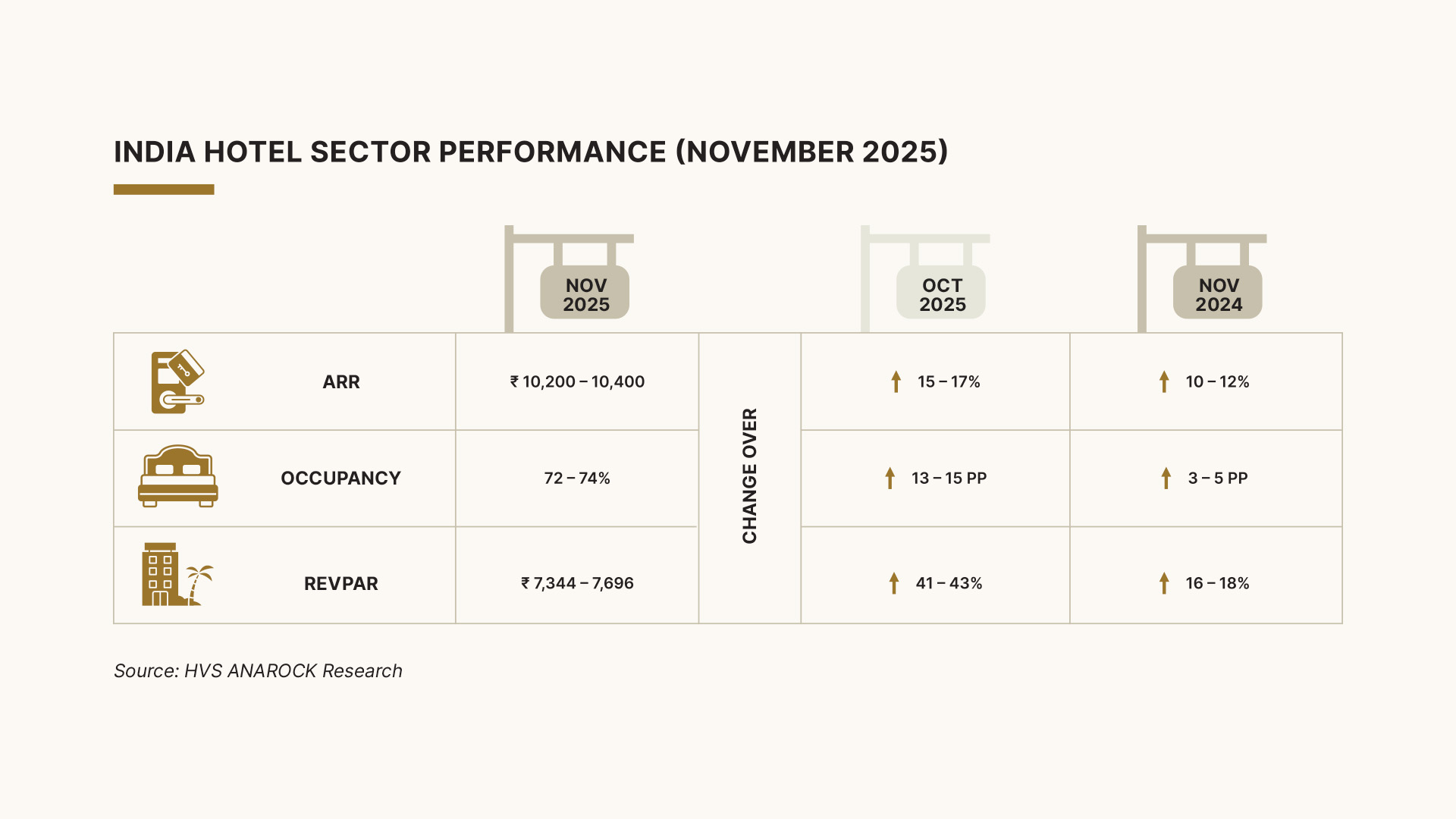

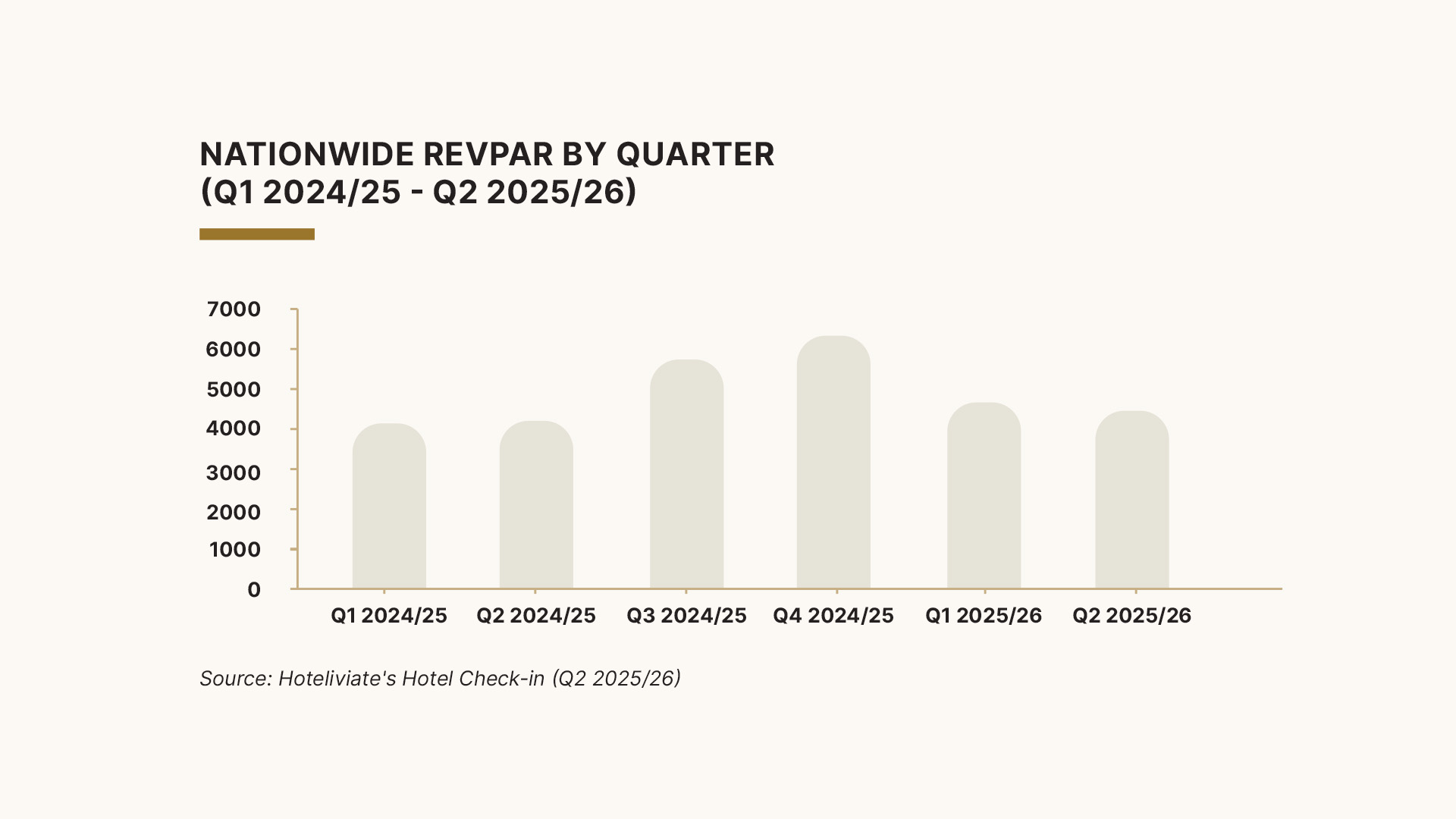

Amid a fast-paced growth cycle in India’s hospitality and travel industry, hotel room rates are expected to rise by up to 6% in 2026 to a band of ₹9,400–₹9,700, driven by sustained domestic tourism, strengthening corporate travel, and demand continuing to outpace supply across most markets. After a period of sharp post-pandemic recovery, industry experts believe the sector is now entering a phase of stabilisation—marked not by stagnation, but by more measured, sustainable growth across occupancies, average room rates (ARRs), and revenue per available room (RevPAR).

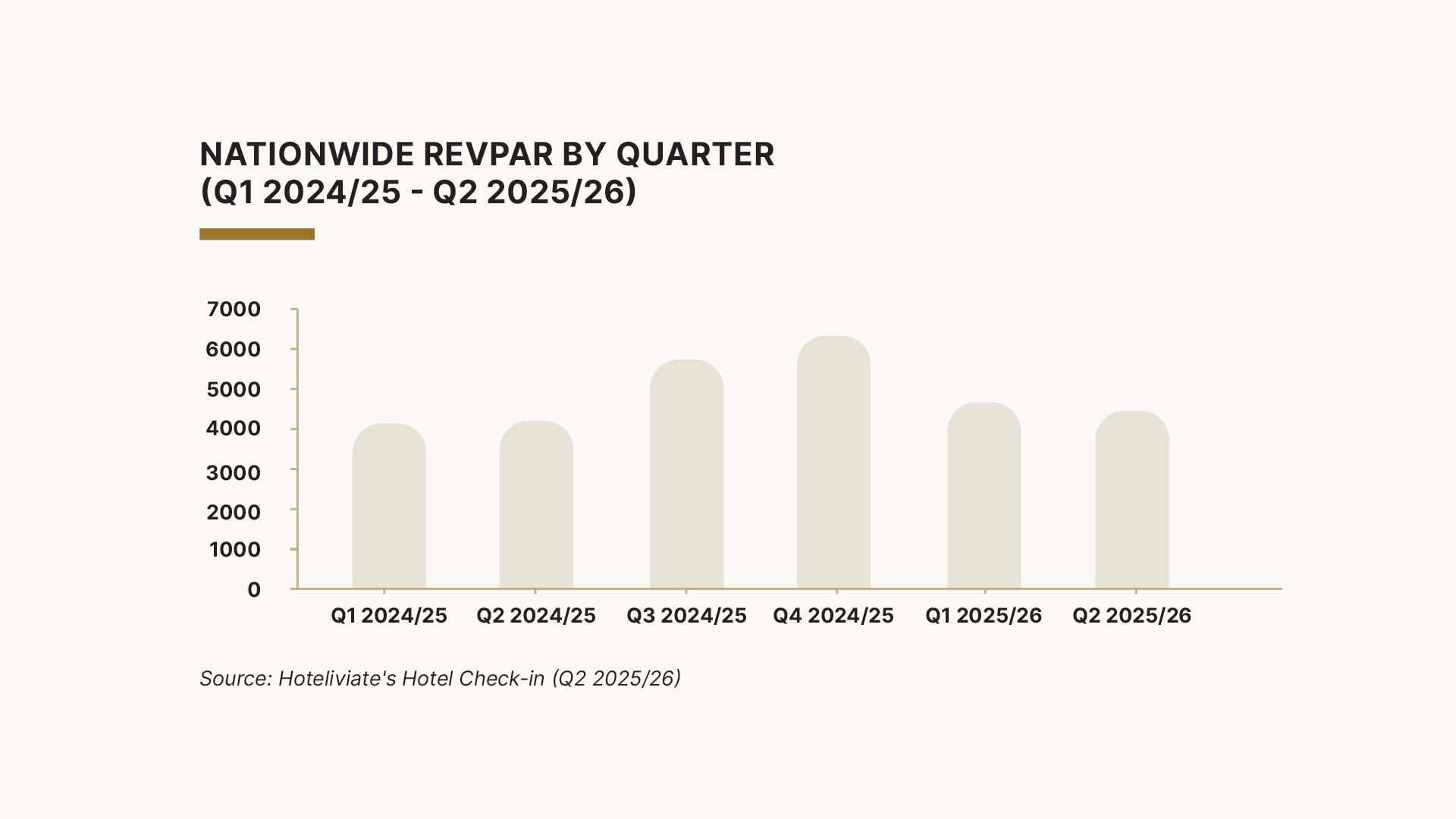

Hotel room rates rose by 7% in 2025 compared with 2024, according to Hotelivate. While December 2025 was expected to extend this momentum, operational disruptions at IndiGo towards the end of the year likely tempered performance in the final month. Consequently, HVS Anarock projects the industry closed calendar year 2025 with occupancies of 65–67% and ARRs between ₹8,800 and ₹9,200. This follows a record-breaking 2024 for room rates and a more volatile 2025, marked by geopolitical tensions, an aeroplane crash, prolonged rains, and intermittent flight disruptions.

“As per HVS Anarock, ARRs are forecast to increase to ₹9,400–₹9,700, with occupancies of around 67–70%, resulting in a projected RevPAR of approximately ₹6,300–₹6,800,” said Mandeep S. Lamba, President and Chief Executive Officer (South Asia), HVS Anarock. He attributes this outlook to sustained domestic travel demand, growing corporate travel supported by office space absorption in key metros, improving international arrivals, and a still-disciplined supply pipeline that continues to support pricing power. The stabilisation of large convention centres such as Jio World Convention Centre, Yashobhoomi Convention Centre, and Bharat Mandapam is also drawing incremental MICE demand, complemented by the growing scale of sports- and live-entertainment-led travel.

Supply trends are also shaping the next phase of growth. In 2026, midscale and upper-midscale hotels are expected to constitute more than 50% of the proposed supply pipeline. The calendar year 2026 will also see an unusually high number of long weekends, likely to encourage incremental short-haul leisure travel to destinations near major cities.

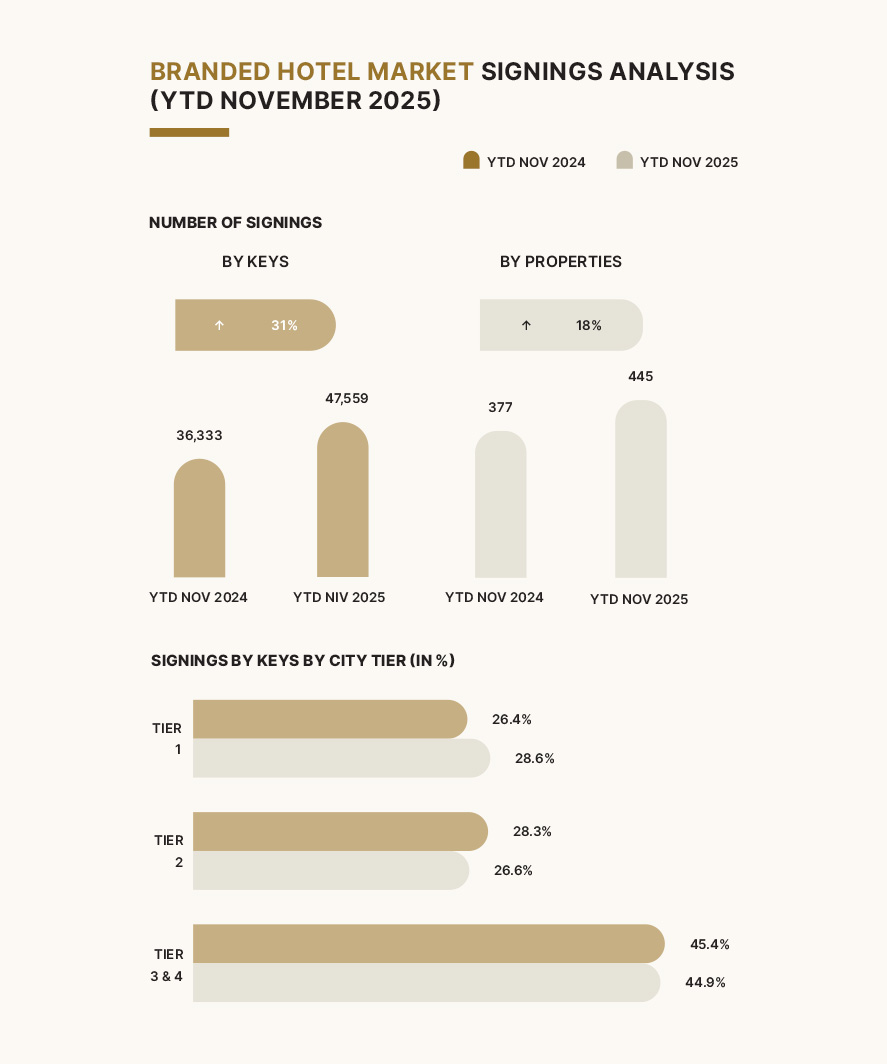

On the supply side, the sector has recorded a surge in signings. Over 47,000 keys have been signed year-to-date in November 2025, reflecting a 31% increase over the same period last year, according to HVS Anarock. With demand broadening across geographies and travel purposes, the sector is steadily building scale, and long-term fundamentals remain firmly in place.

Structural growth driven by domestic demand

According to ICRA, India’s hospitality market is now exhibiting more structural growth, making it less vulnerable to global shocks than in the pre-COVID era. “Demand drivers now include corporate travel, weddings and social events, religious and spiritual tourism, concerts, sports, MICE activities, and leisure-led travel to Tier 2 and Tier 3 cities,” said Sruthi Thomas, Vice President and Sector Head, Corporate Ratings, ICRA, in its recent report.

Despite subdued foreign tourist arrivals in some periods, overall demand remains resilient because domestic travel has become the backbone of the sector. Supply growth continues to trail demand expansion, strengthening pricing power and pushing RevPAR to record highs. ICRA expects sustained demand and pricing power to support revenue growth for the premium hotel segment in H2 FY2026 and FY2027.

ICRA estimates occupancies and ARRs at 69–71% and ₹8,100–₹8,200, respectively, in nine months of FY2026, compared with 69–71% and ₹7,800–₹7,900 in the corresponding months of FY2025. Weddings, long-weekend travel, and steady business travel supported robust occupancies of 76–78% in Q3 FY2025, despite temporary flight disruptions in early December 2025 following revisions in Flight Duty Time Limitation (FDTL) norms. Many travellers extended their stays due to cancellations or adopted alternative transport, while bulk wedding bookings helped cushion the impact.

Asset-light model’s obvious charms

There is also a growing preference for asset-light models such as management contracts and franchise agreements, which generate high-margin, fee-based income and improve return on capital employed. At the same time, large Indian hotel companies are unlikely to go fully asset-light. “Owned assets continue to anchor brand prestige, with prime-city and landmark hotels creating long-term value,” Thomas said, adding that a mixed ownership strategy—retaining core assets, managing or franchising growth assets, and monetising non-core assets—is emerging.

For FY2026, ICRA expects pan-India premium hotel occupancies of 72–74%, broadly in line with FY2024 and FY2025, and ARRs of ₹8,200–₹8,500, up from ₹8,000–₹8,200 in FY2025.

Domestic tourism: The real engine

The scale of domestic travel explains much of this resilience. According to the Ministry of Tourism’s 66th India Tourism Data Compendium (2025 edition), India recorded 2,948 million domestic tourist visits in 2024, a 17.5% increase over 2023. Uttar Pradesh led with 647 million visits, followed by Tamil Nadu with 307 million. The Taj Mahal remained the top monument, attracting 6.26 million domestic and 0.65 million foreign visitors in FY2024–25.

The Compendium also reported 20.57 million international tourist arrivals (ITAs) in 2024, comprising 9.95 million foreign tourists and 10.62 million Non-Resident Indians (NRIs). Tourism receipts rose to USD 35.02 billion (₹2,93,033 crore), giving India a 2.02% share of global tourism receipts and a rank of 15th worldwide. The average tourist stay length was 18.1 days. Key source markets included the USA, Bangladesh, the UK, Australia, and Canada. Purposes of travel were led by leisure (45%), diaspora (28%), business (11%), and medical (6.5%).

The Economic Survey reported that domestic tourism visits increased by nearly 52.7% during January–September 2025 compared with the same period in 2024. Domestic traveller spending was estimated at ₹15.5 trillion in 2024 and is expected to rise to about ₹16.8 trillion in 2025.

In FY2024, travel and tourism contributed 5.22% to GDP and supported about 84.6 million direct and indirect jobs, or 13.3% of total employment. As of June 2025, inbound tourism stood at 1.65 million visitors, outbound tourism at 8.44 million travellers, and foreign exchange earnings at ₹515.32 billion.

Policy push and untapped niches

The Economic Survey noted significant untapped potential in niche segments. India’s vast coastline could unlock the blue economy through modern marina infrastructure, currently almost absent. A national marina development policy enabling private players to operate marinas under transparent permits could support sailing, diving, and leisure cruising, and attract high-value tourism and international regatta events such as the Swan Cup National Regatta.

The Survey also highlighted the potential for long-distance hiking trails comparable to the Appalachian or Camino trails, leveraging India’s ecological diversity and pilgrimage, forest, and river corridors, supported by community-managed micro-lodges, homestays, campsites, standalone green energy, clean sanitation, GPS-enabled navigation, and rescue facilities.

Under the Sustainable and Responsible Tourism (SASCI) initiative, 40 projects across 23 states were sanctioned in FY2024–25 for ₹32.95 billion crore with 100% central funding. Through Swadesh Darshan and Swadesh Darshan 2.0, 110 projects have been developed across thematic circuits, including Ramayana, Buddhist, coastal, and tribal.

Big boom, big tests

There was a time when travel in India largely meant a pilgrimage or a beach holiday. Today, tourism is no longer a side story but a core part of India’s economy and identity. Yet challenges persist: uneven infrastructure, overcrowding, safety and sanitation concerns, pollution, and navigation difficulties for foreign visitors. The central question now is whether infrastructure can keep up, whether destinations can breathe, and whether growth can remain responsible.

For India’s hospitality industry, however, the direction is clear. With domestic travel as its anchor, diversified demand drivers, disciplined supply, and supportive policy frameworks, the sector is moving from rebound to resilience—and from resilience to a more stable, long-term growth trajectory.