How India’s Concert Boom is Powering the Orange Economy

Music concerts are fast becoming a reason to travel in India, filling flights, hotels, and city streets. As music turns destinations into cultural moments, the concert economy is expanding into a defining pillar of the orange economy.

By Deepali Nandwani

On January 25 and 26, 2025, Coldplay played their biggest-ever show at the Narendra Modi Stadium in Motera, Ahmedabad—the largest cricket stadium in the world—as part of their Music of the Spheres World Tour. The concerts drew massive crowds, fireworks, and a special Republic Day performance.

What unfolded was more than a spectacle; it was evidence of India’s evolving live entertainment ecosystem. “The concerts are not isolated cultural moments anymore,” says Samit Garg, President, Event and Entertainment Management Association (EEMA). “They sit at the top of a much larger cultural immersion funnel that is reaching its inflection point in India.”

That inflection point is visible in how global artists now view the country. As Anil Makhija, COO - Live Entertainment & Venues, BookMyShow, “It’s incredibly exciting to see the world’s biggest artists viewing India as a key stop on their global tours. The live entertainment landscape here has evolved at an unprecedented pace, and we’re hearing directly from global partners that artists recognise both the scale of the opportunity and the depth of genuine fandom in this market.

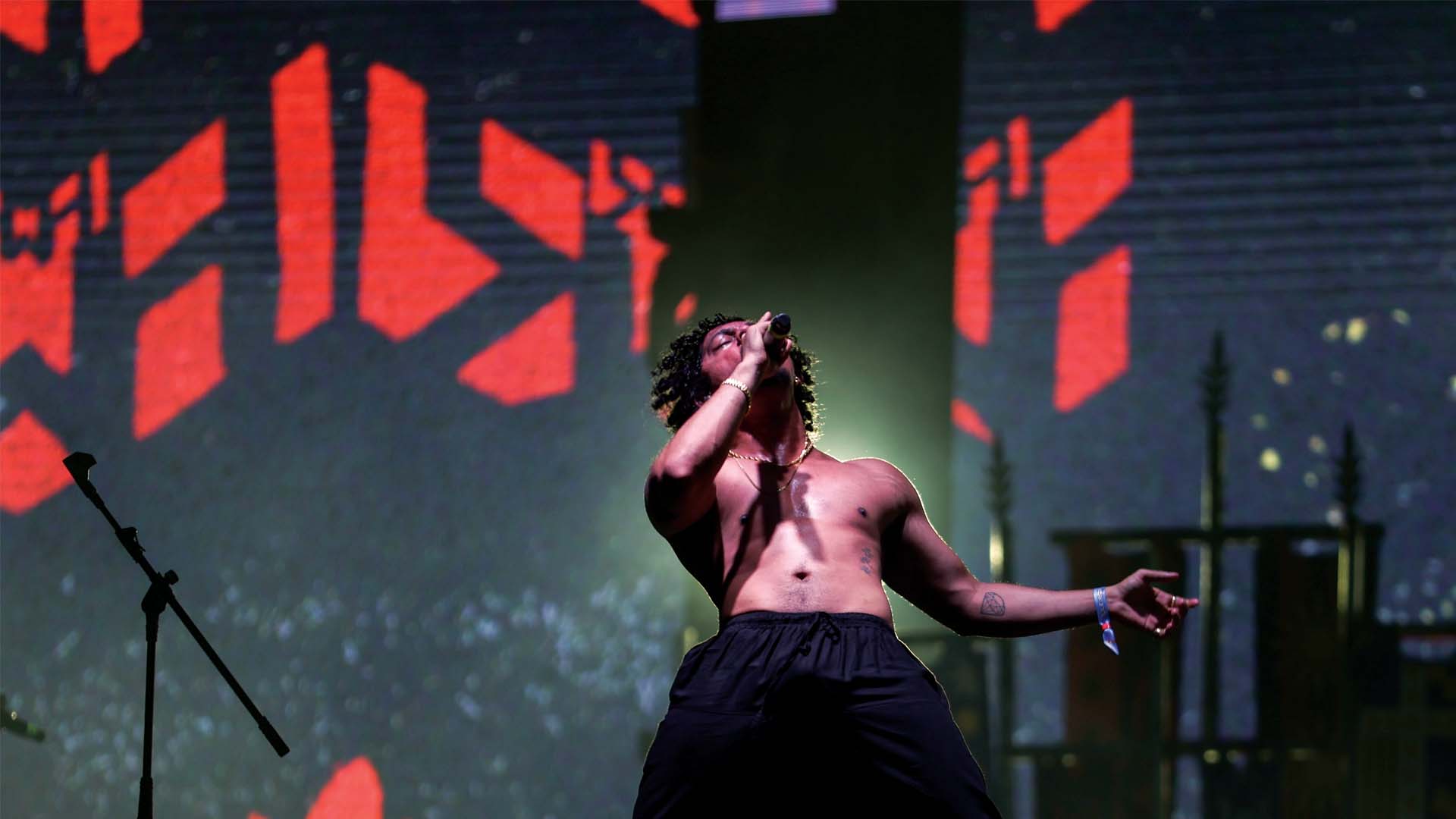

“Indian fans don’t just stream music—they follow artists’ journeys, engage deeply with their stories, and show up in overwhelming numbers to experience them live. That passion has created a ripple effect, making India an unmissable destination for international talent. Travis Scott bringing his Circus Maximus World Tour to New Delhi in October and returning to Mumbai in November—rare within the same tour cycle—signals the growing demand for world-class live music here.”

This inflection point has been building for nearly a decade. Around 2015, you could already see the live concert economy starting to take shape, says Rafael Pereira, Managing Partner at TINNUTS and Executive Trustee of India Music Exchange. “There were two or three companies fighting it out to do the biggest shows. What we didn’t yet have was a strong streaming audience.”

The turning point came with cheap data. “Jio’s free data plans gave people access to YouTube, Saavn, Gaana—and later Spotify,” Pereira explains. “Suddenly, you had close to 600 million people streaming music in India.” Even if only about 10% of that audience listens to international music, he notes, that still amounts to nearly 60 million people, “the population of a couple of European countries put together.”

At Lollapalooza India 2026, Linkin Park drew cross-generational audiences, reflecting the widening base of India’s live music market.

From Spectacle to System

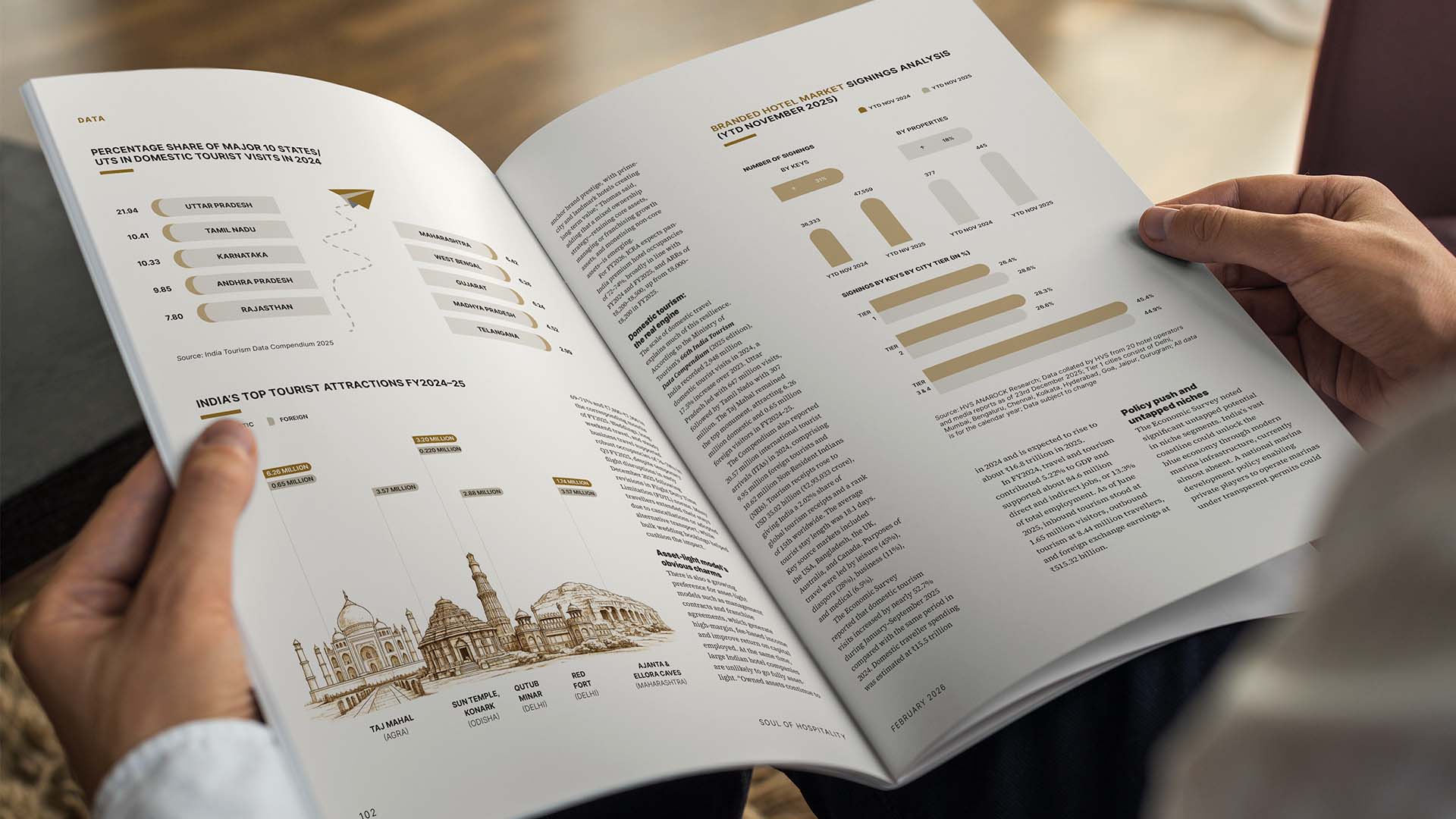

Managed by BookMyShow Live, Coldplay’s Ahmedabad concert became the basis of an April 2025 report by EY-Parthenon and BookMyShow titled India’s Rising Concert Economy: Coldplay’s Ahmedabad Tour Sets the Blueprint. Using extensive survey data and economic modelling, the report mapped how a single global concert can activate a city’s transport, hospitality, workforce, tourism, and fiscal machinery.

Ahmedabad’s airport, for instance, handled 1.38 lakh travellers during the three-day window, including a record 47,000 arrivals on the first concert day. Hotel rates surged to ₹50,000–₹90,000 within 48 hours of the announcement. The concerts generated an estimated ₹641 crore in economic impact, including a direct ₹392 crore boost to the city and ₹72 crore in GST revenues. Nearly 79% of attendees were under 35, a demographic signal that matters deeply.

The concert expanded Ahmedabad’s appeal as a cultural and lifestyle destination beyond traditional heritage tourism, positioning it on the global entertainment map. Seventy-eight percent of surveyed attendees now view Ahmedabad as a major concert city, and two-thirds (66%) expressed strong willingness to return.

This shift has also entered national policy conversations. Prime Minister Narendra Modi underscored it at the Utkarsh Odisha – Make in Odisha Conclave 2025, noting that India’s youth population, cultural heritage, and growing appetite for live events make the concert economy a powerful growth engine. “The incredible images from Coldplay’s concerts in Mumbai and Ahmedabad are proof of how much scope live concerts have in India,” he said.

What we are seeing is not just a rise in ticket sales but a generational shift. As Garg explains, “Young Indians are defining themselves through experiential participation rather than material consumption.” Pereira agrees, but adds an important layer. “The pandemic reset the entire industry,” he says. “Live music was the first to shut down and the last to reopen. But it forced promoters to understand digital engagement, hybrid formats, and audience behaviour at a deeper level.” By the time venues reopened, “the Indian consumer was ready for world-class shows because they had already seen them—on social media, on streaming platforms, or by travelling abroad.”

Travis Scott performs at the finale of his Circus Maximus World Tour.

The incredible images from Coldplay’s concerts in Mumbai and Ahmedabad are proof of how much scope live concerts have in India. I expect the state and the private sector to focus on developing necessary infrastructure and skills for the concert economy.

Narendra Modi

Prime Minister, India

From Touring Stop to Cultural Market

Once, India was an ‘exotic’ touring destination. Today, it is strategic. “Earlier, artists would say, ‘I’d love to go to India,’” Pereira says. “Now it’s about eyeballs, data, and scale. India is one of the major music markets in the world.” This shift is no accident. Over the past two years alone, artists such as Ed Sheeran, Dua Lipa, Enrique Iglesias, Cigarettes After Sex, John Mayer and DJ Snake have played Indian cities, often across multiple stops. Festivals like Lollapalooza India now anchor global tour calendars rather than functioning as one-off extensions. Ed Sheeran didn’t just perform across India; he also collaborated with one of the country’s biggest stars, Arijit Singh, on Sapphire.

Once an afterthought on world tours, India today offers something global artists can’t ignore: one of the world’s largest youth populations, deeply active on streaming platforms such as Spotify, YouTube and Apple Music. This creates clear, data-backed evidence of demand and fan bases across Indian cities. While ticket pricing must adapt to local economics, the sheer scale of the population, the availability of easy credit and credit cards, and strong sponsorship and brand support make touring India financially compelling. Major festivals such as Lollapalooza India and World Music Festival Udaipur now routinely blend Indian and international talent, positioning themselves as integral parts of global tour strategies rather than standalone shows.

A 2022 Chartmetric report captured this shift through the idea of ‘trigger cities’—cities where music trends can activate global streaming algorithms. “Out of 20 trigger cities globally, seven were in India,” Pereira says. “That completely changed how the world looks at us. Even if an artist doesn’t perform here, if their music trends in India, it can become a global hit.” This algorithmic relevance explains why India has become a non-negotiable stop on world tours.

Garg cautions against viewing India merely as a consumption market. “That framing is already outdated,” he says. “India is no longer just a touring destination. It is evolving into a cultural exporter.” According to him, the real transformation lies beyond stadiums. “But the more important shift is the rise of a new experiential economy—one that blends culture, technology, and storytelling into original intellectual property seeded in India.”

The scale of this moment was evident in 2025, one of India’s busiest live music years. International icons—from Travis Scott to Enrique Iglesias—played huge stadium shows, major festivals drew tens of thousands, and local stars toured nationwide. Travis Scott brought his Circus Maximus World Tour to Delhi and Mumbai to massive crowds; Enrique Iglesias staged his Comeback India Tour in Mumbai; Akon’s India Tour included a major stadium performance in New Delhi; and Post Malone chose Guwahati, signalling how the North East has nurtured a live music ecosystem.

Indian artists matched this momentum. Honey Singh live in Jaipur, Arijit Singh’s India Tour, and Sunidhi Chauhan’s I Am Home India Tour each drew audiences of 20,000 to 30,000. Diljit Dosanjh’s Dil Luminati World Tour—widely considered one of the most ambitious Indian music tours to date—blended Punjabi and Hindi hits with global production values across several countries and Indian cities in 2024 and 2025. Pre-sales alone moved over 100,000 tickets in minutes, with general sales following the same pattern. His Delhi shows at Jawaharlal Nehru Stadium added multiple dates due to demand, proving that Indian artists can headline multi-city, stadium-level world tours with record attendance.

Any discussion of India’s concert culture is incomplete without its festivals. Recent editions of Lollapalooza India (2025–2026) have attracted headline acts such as Linkin Park and Shawn Mendes. But before these came the OGs: the high-energy NH7 Weekender, the soulful Ziro Festival in Arunachal Pradesh, the folksy Jodhpur RIFF, and India’s EDM explosion, Sunburn.

Founded by Vijay Nair (former CEO of OML) along with Stephen Budd and Martin Elbourne, NH7 Weekender is widely regarded as India’s first large-scale, professionally produced indie and multi-genre festival, modelled on global formats like Glastonbury, and yet rooted in Indian independent music alongside international acts. It helped legitimise indie music as a mainstream live experience, offering bands such as Prateek Kuhad, The Local Train and Nucleya a platform alongside global names. Sunburn, founded by Percept in 2007 and later taken over by Submerge, was instrumental in introducing modern EDM culture to India long before multi-genre festivals became common.

Launched in 2011, Mumbai’s Mahindra Blues Festival treats blues not just as music but as a cultural movement. A passion project of Anand Mahindra, Chairman of the Mahindra Group, created with festival director VG Jairaman and Oranjuice Entertainment, it has hosted legends such as Buddy Guy, John Mayall, Charlie Musselwhite, Taj Mahal, Tedeschi Trucks Band and Billy Gibbons.

Maharaj Gaj Singh II, speaking about the impact of Jodhpur RIFF, sums up the deeper significance: “Rajasthani folk artists are equal to the best roots musicians in the world… Jodhpur RIFF is proof of this. The festival exists to provide an enabling environment and a superb platform for folk artists. Tourism has given traditional musicians a new lease of life. RIFF helps to promote Jodhpur and, by extension, Rajasthan, as a destination. People are excited to come here and go back with happy memories. The hotels are always full at this time of the year… people have come to the festival multiple times.”

Ed Sheeran returned to India to sold-out arenas, reflecting sustained fan demand beyond one-off events.

Not Just Metro Mania

While Mumbai, Delhi and Bengaluru remain anchor markets, the most interesting story is unfolding elsewhere. BookMyShow data shows rapid growth in live-event engagement in several Tier 2 and emerging cities:

Cities once peripheral to touring circuits are becoming destinations in their own right. Improved venues and strong regional fan bases allow artists to travel deeper into India—and fans to follow. This decentralisation spreads concert culture beyond saturated metros while creating new micro-markets for hotels, short-term rentals, homestays, and local experiences.

Samit Garg, President, Event & Entertainment Management Association.

Concerts provide counterbalance to isolated digital lives—creating what scholars term ‘sacred-digital liminality’ where technology enables transcendent communal experiences. Research from Bhavan's College MSEED reveals that concerts address deep psychological needs for collective experience in an increasingly atomised society.

Samit Garg

President, Event & Entertainment Management Association

The Credit Economy Behind the Concert Boom

One of the least discussed but most decisive forces behind this boom is access to credit. “Nobody really talks about this,” Pereira says. “But we are living in a credit economy.” In the early days, festivals like Sunburn sold tickets on EMI because their audience didn’t have credit cards. “Today, because of how RuPay and NPCI have changed credit policies, the same young consumers buying Netflix or Spotify subscriptions are also buying concert tickets,” he explains. “They’re eating out, shopping, travelling—and they have serious FOMO. Being at the biggest concert in the city has become a social and cultural moment, sometimes even more than love for the artist.”

This shift, he argues, has fundamentally altered promoter economics.

The structure of India’s live music industry has also changed. “The promoters from back in the day are largely gone,” Pereira says. “Percept sold Sunburn to BookMyShow. OML sold NH7 Weekender to NODWIN Gaming. Viacom18 shut down Supersonic.”

Today, ticketing platforms such as BookMyShow and District by Zomato are not just distributors—they are financiers. “They’re bankrolling promoters across India by giving advances against ticket sales,” he explains. “In the past, that capital simply didn’t exist.” As a result, ticketing platforms have become promoters themselves—fuelled by the need to grow scale, valuation, and reach.

Lollapalooza India 2026 drew sustained crowds across performances.

The Orange Economy

641 crore

The Coldplay concert in Ahmedabad in January 2025 generated an estimated ₹641 crore in economic impact, including a direct ₹392 crore boost to the city and ₹72 crore in GST revenues.

2.5 trillion

The media & entertainment sector (a core part of the orange economy) is valued at roughly ₹2.5 trillion in 2024, with strong growth driven by digital adoption and youthful consumption patterns by the Indian government, as revealed in Budget 2026.

20,800 crore

EEMA values India’s live entertainment sector at over ₹20,800 crore and on track to double by 2030.

World-class events

This surge is more than just sold-out shows; it’s a massive economic engine boosting tourism, creating thousands of jobs, and positioning India as a premier global destination for world-class events.

12,000 crore

The live entertainment segment in India surpassed ₹12,000 crore in 2024 and is expected to grow at a 19% CAGR over the next three years—showing strong expansion potential for festivals, tours, and large-scale live events.

(The EY-Parthenon BookMyShow Live report, 2025)

Audiences exceeded 10,000

There were between 70–80 major concert days in 2024 where audiences exceeded 10,000, signalling strong demand for large-scale live entertainment.

(The EY-Parthenon + BookMyShow Live report, 2025)

5.6 lakh Indians on the move

Over 5.6 lakh Indians travelled across cities in 2025 specifically to attend concerts.

(BookMyShow’s Throwback 2025 report)

34,086 live events

The growth in live entertainment in 2025 was at 17% growth, with 34,086 events across the country.

(BookMyShow’s Throwback 2025 report)

Music as Reason to System

Not long ago, Indian travel revolved around beaches, hill stations, pilgrimages, and the occasional destination wedding. Today, a new catalyst is quietly filling flights, hotel rooms, and late-night cafés: the concert. Music gigs are no longer just evening plans; they’re shaping weekend itineraries, long-weekend escapes, and increasingly, the sole reason a destination is chosen. What began as fandom is fast becoming a habit of movement.

From Coldplay fans flying into Ahmedabad to festival-goers hopping cities for Lollapalooza, and indie loyalists travelling to Shillong, Guwahati, and Ziro Valley, India is witnessing the rise of music-led tourism.

A nationwide Airbnb survey shows 62% of Indian Gen Z plan to travel for concerts or music festivals in 2026. A gig in Pune becomes café hopping; a festival in Goa turns into a four-day beach break; a concert in Ahmedabad becomes a city-exploration weekend. As Amanpreet Singh Bajaj, Country Head – India and Southeast Asia, Airbnb, notes, “Music is becoming a gateway to discovering new destinations, driving demand for stays that allow groups to spend time together and create shared experiences. At Airbnb, we’re seeing how concert tourism is opening up entire neighbourhoods and communities to young travellers, and the meaningful impact this creates. This emerging form of exploration is reshaping traveller behaviour, driving a rising demand for stays that allow groups to spend time together, gather comfortably, and create memorable shared experiences which is perfectly aligned with what Airbnb offers”

This behaviour is increasingly structural. “Concerts have become identity markers—signals of cultural literacy and belonging,” says Garg. EEMA-backed research reinforces this: 53% of attendees extend their stay beyond the event, and every ₹1 spent on a concert ticket generates ₹4–₹5 in local economic activity.

Maroon 5 made their India debut at Mumbai’s Mahalaxmi Racecourse, performing hits for fans across the country.

Anil Makhija, COO – Live Entertainment and Venues, BookMyShow.

As we stand at the cusp of a new era in live entertainment, one defining trend is its decentralisation. A rapidly expanding, geography-agnostic audience is willing to travel across India for world-class experiences. This is inspiring international and Indian artists to explore cities beyond traditional metros, positioning India on the global touring map.

Anil Makhija

COO – Live Entertainment and Venues, BookMyShow

Building a Grassroots Music Culture

Beyond headline concerts and stadium tours, a quieter yet influential music movement is taking shape across Indian cities. Community-led formats such as open jamming sessions, bhajan clubbing, and curated music circles are creating spaces where young people don’t just consume music—they participate in it.

Often held in parks, cafés, rooftops, and co-living spaces, jamming sessions bring musicians and non-musicians together to improvise and collaborate. With no rigid stage–audience divide, they foster experimentation, peer learning, and a sense of belonging, making music feel accessible rather than elite.

Bengaluru’s Tangy Sessions reflects this shift towards intimate, experience-led formats. Conceived as a music and arts initiative, it curates small, immersive showcases focused on original compositions and independent artists. Stripped-down performances, live looping, and artist–audience conversations deepen engagement, prioritising authenticity over scale.

Meanwhile, bhajan clubbing and bhajan jamming blend devotional music with contemporary soundscapes and collective singing, reframing tradition for younger audiences seeking meaningful social experiences beyond nightlife.

Together, these grassroots initiatives are nurturing a participatory music culture rooted in connection, shared experience, and cultural continuity—quietly reshaping how India’s youth engage with music.

India’s independent touring circuit took shape through steady live runs by artists such as Prateek Kuhad.

The Evolution of Orange Economy

This travel momentum is part of a much larger economic shift. The orange economy refers to economic activities driven by culture, creativity, and intellectual property, where ideas, talent, and storytelling are the main raw materials. It spans the arts, culture, media and entertainment, music, design, publishing, gaming and animation. In India, the Economic Survey 2025–26 highlights live entertainment and concerts as powerful growth engines, capable of boosting urban services, tourism, and employment.

The media and entertainment sector—one of the core pillars of the orange economy—was valued at roughly ₹2.5 trillion in 2024, with strong growth driven by digital adoption and youthful consumption patterns. Within this landscape, live concerts and festivals are increasingly seen as high-multiplier economic activities. They generate revenue not only from ticket sales, but also through tourism, hospitality, logistics, advertising, media production and local employment.

“India’s live entertainment sector has surpassed the ₹12,000 crore mark in 2024 and is projected to grow at a CAGR of around 19% over the next three years,” says Raghav Anand, Partner and Leader – Digital, Media and Convergence, EY-Parthenon. “The surge reflects not just rising disposable incomes but an evolving cultural fabric that craves immersive experiences. The economic potential creates ripple effects across allied industries.”

Those ripple effects are already visible. As EY-Parthenon and BookMyShow underline, large-format concerts generate far more than ticket revenue. Hospitality, transport, logistics, and city services all come into play. The Coldplay concerts in Ahmedabad demonstrated how airports, mobility networks, venues, and municipal systems can be stress-tested—and elevated—by global acts, turning logistical pressure into a showcase of readiness.

Crucially, this is no longer a metro-only phenomenon. Cities such as Visakhapatnam, Vadodara, Indore, Shillong, and Rajkot have seen sharp increases in live-event participation, pointing to a genuinely pan-India appetite for music-driven cultural travel.

Consumer behaviour is evolving in step with this shift. “In my 20 years in live entertainment, this is probably the best time for it,” said Kunal Khambhati, CEO, District by Zomato Events, at FICCI Frames. District, which manages NH7 Weekender, brought the Hukum World Tour and rapper Lil Pump to India in 2025 and staged one of Ilaiyaraaja’s largest concerts—clear signals of the country’s appetite for live experiences. The industry, Khambhati says, has “only touched the tip of the iceberg,” already growing 30–40%, with the potential for a 10x expansion as tech-driven players like Eternal reshape consumer behaviour.

The economic impact becomes clearest when events disappear. When Sunburn moved out of Goa for its 2025 edition—following community concerns, regulatory hurdles, and strategic repositioning—restaurateurs and service providers reported revenue drops of 20–30%. Despite steady visitor numbers, the absence of a flagship music event visibly dented peak-season momentum.

As consumer behaviour evolves, travel platforms and hotels are rewriting their playbooks in real time. Agoda has recorded hotel search spikes of several hundred percent around major concert dates, particularly in Mumbai. Cleartrip and EaseMyTrip report consistent uplifts in airfares and room demand tied to large shows. “Travellers arrive with their concert ticket first, and then build the rest of the weekend around it,” says Manjari Singhal, Chief Growth & Business Officer, Cleartrip.

The response is increasingly sophisticated: venue-adjacent stays, concert-weekend packages, late check-outs, recovery brunches, curated night trails, and seamless transfers. For hotels and OTAs, the line between a concert ticket and a travel product is beginning to blur. Booking.com points to rising demand for single-occupancy rooms, boutique hotels near venues, and social hostels.

Rafael Pereira, Managing Partner, TINNUTS, and Executive Trustee, India Music Exchange.

The concert industry was gathering momentum until the pandemic forced shutdowns and delayed reopening. Promoters rethought music through digital and hybrid formats, raising expectations shaped by global shows viewed on social media. By 2022, audiences were ready. A key inflection point was U2’s Mumbai concert.

Rafael Pereira

Managing Partner, TINNUTS, and Executive Trustee, India Music Exchange

From Touring Destination To Music Market

The shift from India as a touring stop to a strategic music market has triggered a deeper change: the emergence of institutional platforms that treat music as trade, not just entertainment. One of the clearest signals of this evolution is India International Music Week (IIMW). Launched in Mumbai in February 2025 under the India Music Exchange, IIMW was conceived as India’s first truly international, B2B-focused music trade conference and showcase. Its goal was to address a long-standing structural gap in the ecosystem: while India had scale, audiences, and data, it lacked a formal platform for multilateral exchange connecting Indian artists, managers, labels, and promoters directly with global bookers, festival curators, agents, and music executives.

“The best way to demonstrate what multilateral music trade actually looks like was to create an event that displays it,” says Rafael Pereira, Managing Partner at TINNUTS and Executive Trustee of India Music Exchange. The idea gained urgency post-pandemic, as European markets began viewing India not just as a touring destination but as a serious streaming and talent market. Unlike consumer-facing festivals, IIMW was designed as an industry marketplace with a deliberate 50:50 mix of Indian and international speakers and artists.

Kunal Khambhati, CEO, District by Zomato Events, at FICCI Frames.

In my 20 years in live entertainment, this is probably the best time for it. The industry only touched the tip of the iceberg,” already growing 30–40 percent, with the potential for a 10x expansion as tech-driven players like Eternal reshape consumer behaviour.

Kunal Khambhati

CEO, District by Zomato Events, at FICCI Frames

From Concerts to Cultural-Tech Experiences

The momentum created by live entertainment is now spilling into a broader wave of cultural-tech experiences that blend storytelling, technology and intellectual property into new forms of large-scale public engagement. As audiences grow more comfortable spending on immersive experiences, the creative economy is expanding beyond concerts into permanent and travelling formats that merge art, technology and culture.

Garg points to the emergence of what he calls “cultural-tech”, a category where India holds a unique advantage. “Japan exports anime. Korea exports K-dramas,” he says. “India has always owned the civilisational raw material of mythology—but we never learned to tell it in a future-ready language.”

That is beginning to change.

One example is Shiva Immersive, India’s first permanent-format immersive mythology installation, a $2 million production using 360-degree projection mapping, spatial audio, kinetic scenography, and AI-powered dramaturgy. The experience reimagines Shiva not through ritual worship but cinematic, sensory storytelling. “This represents a fundamental shift,” Garg explains. “Audiences are engaging with ideas of consciousness, creation, and destruction aesthetically—not devotionally.”

Crucially, such formats are creating entirely new job categories—experience architects, mythology-technologists, projection engineers, spatial sound designers—roles that barely existed in India five years ago. Parallel examples include the Van Gogh Immersive Experience in Bengaluru and the AI-driven Digital Experience Centre at Maha Kumbh 2025, where AR, VR, LiDAR, and holograms enabled what scholars have termed “digital darshan”.

“These are not fringe experiments,” Garg says. “They signal the maturation of India’s creative economy.”

Culture-tech experiences are gaining ground, with projects like Shiva Immersive redefining what live entertainment can look like.

The Wider Impact

Traditional tourism marketing sells destinations. Music tourism sells moments. When a city hosts a global artist, it doesn’t just gain footfall—it enters the pop-culture conversation. Social media amplifies it, fans attach memories to the destination, and repeat visits follow. Recognising concerts as fast, high-impact demand drivers, state tourism boards are now collaborating with event platforms to attract large-scale tours.

In 2025, Assam formally introduced a Concert Tourism Policy to attract international artists and position the state—especially Guwahati, Jorhat, and Dibrugarh—as destinations for big-ticket live events. Plans include upgrading venues such as Dibrugarh’s Khanikar Stadium into a 35,000-seat facility and building new performance arenas. Grammy-winning artist Post Malone’s Guwahati concert was positioned as a catalyst for this push, expected to draw visitors from across South and Southeast Asia.

Says Makhija, “BookMyShow Live has been working closely with various state governments to build the foundation for this next phase of growth. We’ve recently signed Memorandums of Understanding (MoUs) with Assam Tourism, Telangana Tourism, Gujarat Tourism and Delhi Tourism, so far. Together with state governments these MoUs will facilitate the entry of more national and international acts, strengthen infrastructure, drive skill development and uplift the local ecosystem, further strengthening each of the state’s live entertainment ecosystem, while leveraging the state’s robust infrastructure, cultural vibrancy and readiness to host large-scale entertainment events.”

Shillong, long known for its rock culture and music festivals, continues to elevate its profile with international concerts. The Meghalaya government is investing in airport expansion, hotels, and performance infrastructure to manage increased tourist traffic. Rajasthan, meanwhile, uses music festivals to augment its traditional tourism appeal—forts, palaces, and lakes—with live performances.

In a young country where cultural consumption is evolving rapidly, music offers something rare: predictable demand with emotional intensity. “Concerts are not temporary events anymore,” Garg emphasises. “They are economic engines, talent incubators, and global branding tools.”

This mirrors a broader shift towards experience-led holidays. Thomas Cook and SOTC’s India Holiday Report identifies music, festivals, and cultural experiences as emerging travel motivators. Concert tourism is socio-economic impact tourism: from airlines to cafés, auto-rickshaws to heritage hotels, the gains ripple widely.

From Shillong and Guwahati to Indore and Vadodara, Tier 2 cities are seeing explosive growth. “Fandom doesn’t recognise metros and non-metros,” Garg says. “Young Indians everywhere have equally sophisticated aesthetic expectations.”

NH7 Weekender, a defining presence in India’s formative festival era.

Infrastructure the Bottleneck

Yet, even as demand for live music surges, India’s infrastructure is struggling to keep pace. Venue capacity remains uneven and underbuilt compared to global markets, with most spaces not purpose-built for large-scale music productions. India currently has fewer than 10 venues with capacities above 10,000 people suitable for big shows, largely concentrated in Tier 1 metros or cities like Ahmedabad.

Pereira sees the tension clearly. “Audiences today expect world-class experiences because they’ve consumed them digitally,” he says. “The question is whether our venues and systems can deliver that consistently.”

Industry players argue that venue transformation is already underway. “We are making steady progress and investing significantly in infrastructure to position India as a fixed stop on global tour circuits, while developing multi-purpose, accessible venues and repurposing underutilised spaces to attract world-class talent,” says Makhija. “A prime example is Mahalaxmi Racecourse in Mumbai. “In collaboration with authorities, we are transforming the space into a consumer-friendly, ready-to-use venue. Before every show, we clear tons of debris and revitalise neglected areas, rebuilding the entire festival infrastructure from the ground up.”

The long-term vision, he says, is to streamline approvals and upgrade the Racecourse into a plug-and-play venue that meets global standards. The transformation has already enabled large-format productions such as Lollapalooza India—with four stages and immersive experiences including the curated Lolla Food Park—and Ed Sheeran’s Tour in 2024, for which a full stadium-style set-up was created at the venue. “In Bengaluru, we have made similar strides, hosting large-scale events at venues such as Embassy International Riding School, NICE Grounds, Bhartiya Mall of Bengaluru and others. BookMyShow Live actively collaborates with landowners to repurpose unused spaces into vibrant event locations, building festivals and concerts from the ground up.”

This gap entered public conversation during Dosanjh’s Dil Luminati World Tour, when the artist openly criticised India’s lack of concert-ready infrastructure. His comments highlighted not just the shortage of large venues, but an even more acute absence of mid-size spaces that can support touring artists at scale.

The issue was laid out starkly in Experience India, an Eventfaqs white paper released in May 2025. To rank among the world’s top five live entertainment destinations by 2030, the report says, India must increase its number of purpose-built concert venues from fewer than 10 today to at least 25–30. Equally critical is the missing “middle layer”: venues with capacities between 2,000 and 10,000. These spaces are essential for touring IPs, regional artists, experimental formats such as immersive theatre, and genre-specific events like hip-hop or folk festivals—formats that do not justify stadium-scale production but require professional infrastructure.

“Countries that have emerged as live entertainment powerhouses have invested in multi-use, high-capacity, and strategically located venues that serve as cultural landmarks and economic drivers,” the paper notes, citing examples such as London’s O2 Arena, Dubai’s Coca-Cola Arena, and Singapore’s Marina Bay Sands and Gardens by the Bay.

“The gap is not just physical,” Garg points out. “It’s also about standardisation, safety protocols, and predictable compliance.” From EEMA’s perspective, professionalisation has advanced rapidly—India now has world-class production talent and specialised creative crews—but regulatory fragmentation continues to limit scale. “Organising a large concert still requires permissions from multiple authorities, often without a single-window system,” Garg continues. “That uncertainty hurts scale.” He believes industry bodies like EEMA can play a catalytic role by setting national standards, enabling skilling, advocating for venue development, and helping India export experiential IP globally. “The stakes are high,” he adds. “If India builds the right frameworks now, it won’t just host global tours—it will define the future of cultural-tech and live experiences worldwide.”

Khambhati acknowledges the gaps from an organiser’s standpoint. “We need to improve the experience,” he says. “The questions often asked are: will the food be okay, will I get parking, will it be safe? There is a need to solve all these problems. We are talking to venues to solve accessibility issues.”

The Eventfaqs paper argues that part of the solution lies in reimagining India’s idle urban infrastructure—mills, docks, rail yards, and factories—as cultural districts, similar to Melbourne’s Docklands or Dubai’s Al Quoz Creative Zone. State-led mapping of redevelopment-ready zones, long-term leases or joint ventures with culturally aligned developers, and incentives for mixed-use precincts that combine food, retail, and performance spaces could accelerate venue creation significantly.

Change, however, is beginning to appear on the ground. Navi Mumbai, already home to the DY Patil Stadium, is set to receive a major addition: a world-class indoor live entertainment arena modelled on global icons like Madison Square Garden and London’s O2 Arena. With seating for 20,000 and standing capacity for 25,000, the venue is designed to host international concerts, sporting events, cultural festivals, and immersive experiences. CIDCO’s plans aim to reposition Navi Mumbai not just as a residential hub, but as a live entertainment and tourism destination.

Connectivity is strengthening in parallel. With the Atal Setu Trans-Harbour Link, the upcoming Metro network, and the new international airport, access to large venues is becoming easier—an essential ingredient for sustained concert tourism.

Policy thinking is also evolving. The EY-Parthenon BookMyShow Live report outlines a replicable blueprint for cities to use live entertainment as a long-term economic and cultural driver. Central to this is public–private partnership: governments and promoters collaborating to build venues, improve transport links, and strengthen safety and crowd-management systems. Dedicated PPP task forces can streamline coordination across authorities, artists, promoters, and service providers.

The report also recommends single-window clearance systems to reduce regulatory friction, inter-departmental coordination for crowd control and traffic management, and incentives such as temporary tax reliefs or predictable approval fees to attract global acts—especially to non-metro cities. Equally important is investing in flexible, multi-use venues that can host concerts, sports, festivals, and conventions year-round, improving utilisation and return on capital.

Cities and states that simplify policies, speed up approvals, and offer transparent processes stand to gain the most. As the report notes, ease of doing business is fast becoming as important to live entertainment as audience demand itself.

India’s concert boom is no longer just about who’s on stage, but what gets activated beyond it—cities, careers, culture, and creativity. As Pereira puts it, “India has moved from being an exotic stop to a data-driven, algorithmically powerful market. That’s not cyclical. That’s structural.” In that shift lies the real promise: not just growth, but identity, storytelling, and an expression of India’s cultural power.

Diljit Dosanjh’s Dil Luminati proved that Punjabi pop could command stadiums on its own terms—language intact, scale uncompromised.

Amanpreet Singh Bajaj, Country Head – India and Southeast Asia, AirBNB.

Music is becoming a gateway to discovering new destinations, driving demand for stays where groups can spend time together and create shared experiences. Growing interest in concerts and festivals is shaping a new traveller who journeys for music-led discovery.

Amanpreet Singh Bajaj

Country Head – India and Southeast Asia, Airbnb

Hanumankind’s popularity signals hip-hop’s growing presence on India’s live circuit.